Table of Contents

Preface

Are you a Chennai citizen? And a working professional or an aspirant in the accounting and taxation industry?

Do you wish to upgrade your accounting and taxation skills and give a boost to your career?

Maybe you have been practicing Accounting and Taxation courses for years but not earning a desirable salary. Then, try adding some skills to your bucket.

Accounting and Taxation Course | GST Training & Certification

Become expert in GST Return Filing, Invoicing, Software, Supply, ITC etc

$99 FREE

Access Expires in 24Hrs

Upcoming Batches of Accounting and Taxation Course :-

| Batch | Mode | Price | To Enrol |

|---|---|---|---|

| Starts Every Week | Live Virtual Classroom | 34500 | ENROLL NOW |

Upcoming Batches of Accounting and Taxation Course :-

| Batch | Mode | Price | To Enrol |

|---|---|---|---|

| Starts Every Week | Live Virtual Classroom | 34500 | ENROLL NOW |

Maybe you have just completed your 12th from commerce or a recent commerce graduate and do not know what to do next. Then, try going for a certification course and start your career right away!

Maybe you are the one but do not where to enroll to furnish your skills.

Then, let me share a piece of good news with you! Your pursuit stops here!

I have done extensive research for you for this blog and enlisted the Top 10 The courses listed in this blog are both offline and online.

As almost every institute offering online classes considering the current pandemic conditions, you will find most online courses in this blog.

1. Henry Harvin: Best BAT Course in Chennai

Course Specifications:

The University of Virginia offers the course Financial Accounting Fundamentals on the platform of Coursera. The University of Virginia is a chief association for higher studies. With the world-class faculty and remarkable scholars, the University of Virginia stands out.

Thomas Jefferson, the third President and the Founding Father of the United States, founded the University of Virginia in 1819. The vision he had in building the university was to discover, innovate, and develop maximum capabilities in the students.

The alumni of Financial Accounting Fundamentals reviewed the course as the best one. The program has 510+ positive reviews on Coursera’s website.

Duration:

The approximate time to complete the course is 14-hours.

Subscription Fees:

The participants can enroll in the Financial Accounting Fundamentals course for free. But with free enrolment, the participant will not be able to access graded assignments and earn a certificate.

The students can enjoy access to the graded assignments and earn a certificate with the purchase of the Certificate.

Coursera also provides financial help to those students who can not afford the high fees.

Conspectus:

The curriculum, first, introduces you to Financial Accounting, Financial Statements, Balance Sheets, and Recording Transactions. Then it will take you to other topics such as cash flow, financial statement preparation, annual report, etc.

Additional Perks:

- The instructor for the accounting and taxation course in Coursera will be Luann J. Lynch. She is a professor of Business Administration at the Darden School of Business.

- The perks of purchasing the Certificate are that participants can access course materials, practice quizzes, graded quizzes with feedback, and graded assignments with feedback.

- The Financial Accounting Fundamentals course is 100% online.

- The course also offers flexible deadlines to the participants. It means that participants can complete the course as per their suitable timings.

- The level of this course is beginners level.

Certificate:

Only those who opt for the premium course will receive certification on the successful completion of the program.

The certificate is shareable to a LinkedIn profile, on resumes, CVs, and other documents.

Henry Harvin Business Accounting and Taxation (BAT)Course Fees:

https://www.henryharvin.com/accounting-and-taxation-course#upcoming-batches

Other Cities were Henry Harvin Courses are provided:

Delhi, Mumbai, Bangalore, Hyderabad, Kolkata, Pune, Noida, Gurgaon

Henry Harvin GST Course Ranks #1 in India by Tribune India

Other Courses provided by Henry Harvin:

Also Check this Video

2. ICA Edu Skills – Best BAT Course in Chennai

Contact no: +91 8003458000

Course Specifications:

Business Accounting Taxation courses is the course offered by ICA Edu Skills. ICA Edu Skills is in partnership with National Skill Development Corporation (NSDC) and Skill India. ICA Edu Skills is badged with many awards including Certificate of Excellence from the National Education Excellence Awards.

ICA Edu Skills is a skill development and training institute holding expertise in the fields of accounts, finance, taxation, etc. Founded in 1999, ICA Edu Skills aims to decrease the unemployment rate in India by offering job-oriented courses.

Duration:

Business Accounting Taxation is a short-term course.

Conspectus:

The curriculum of Business Accounting Taxation covers various topics such as direct taxes, indirect taxes, e-filling, journal entry, tax-related transactions, GST, and more.

Learning Mode:

The students can either opt for online sessions or classroom networking.

The classroom training includes a fully equipped computer lab, exhaustive study notes, mock interview sessions, job grooming, and much more.

Additional Perks:

- The course offers industry oriented curriculum.

- Practical training in GST, Income Tax, etc.

- ICA provides learnings based on case studies.

- The participants will also learn software such as Tally, along with advanced excel and Payroll Management.

- Industry experts will be training the participants.

- ICA Edu Skills offers an 80% practical and 20% theoretical curriculum.

Certificate:

ICA Edu Skills rewards Business Accounting Taxation course graduates with professional certificates. With the professional certificate in your hands, you can apply for a vocation in both national and international firms.

Job Placement and Support:

ICA Edu Skills has a set of Job-guarantee courses, known as Certified Industrial Accountant courses. The participants under these courses are given 100% job placement assistance. The graduates also get an Any time Job (ATJ) card that gives access to 30+ placement cells.

Course Fees and Duration:

Course Fees: INR 70,000

Course Duration: 10 months

Address: Unit No. ECSL1401, EcoCentre Business Park, EM Block, Sector V, Salt Lake, Kolkata, West Bengal 700091

Location: Kolkata

Website Link: https://www.icacourse.in/

3. Synergy SBS – Best BAT Course in Chennai

Contact no: +91 4445966100

Course Specifications:

Synergy SBS offers the accounting and taxation course under the name of Business Accounting and Taxation (BAT). The students whose interest is in finance and taxation, Business Accounting and Taxation (BAT) course by Synergy SBS is best for you.

Synergy was established in 2014 and comes among the world’s largest Registered Education Providers of Project Management Institute. Synergy’s alumni count more than 50k+ and 3000+ PMPs trained.

Duration:

Business Accounting and Taxation (BAT) course by Synergy SBS offers 120 hours sessions.

Conspectus:

The course content of the Business Accounting and Taxation (BAT) includes Practical accounting, GST, Income Tax, Payroll, and Advanced Excel.

Additional Perks:

- The course content is industry-oriented and up-to-date.

- The curriculum of the Business Accounting and Taxation (BAT) course in Synergy is practical.

- The trainers for the course are industry experts.

- Practical knowledge of advanced excel, payroll management, and accounting software (Tally).

- Practical training in GST and Income Tax.

- The course offers exhaustive study notes to the students.

- Synergy SBS has also designed discussion forums dedicated to student-aid and career services.

Certificate:

The students can showcase their professional skills with the certificate they will receive after completing the course.

Job Placement and Support:

Synergy SBS guarantees 100% job placement assistance to its graduates.

Course Fees and Duration:

Course Fees: 10900/-

Course Duration: 180 Days

Address: 1st Floor, K.R. Ahamed Sha office complex, No. 25, Dr. Radhakrishnan Salai, Mylapore, Chennai – 600 004, Tamil Nadu, India.

Location: Chennai

Website Link: https://www.synergysbs.com/

4. The Institute of Professional Accountants

Contact No. – +91 9213855555

Course Specifications:

The Institute of Professional Accountants (Govt. Regd.) offers the accounting and taxation course with the name Post Graduate Diploma in Taxation Course (DTL). The course offers practical insight into subject matters of income tax and Goods and Services Tax (GST).

The course is designed especially for those who desire to be Tax consultant/advisor/practitioner. The capital of India is the home of the Institute of Professional Accountants (Govt. Regd.) The institute provides both regular classroom training and online class training.

Duration:

The students complete the Post Graduate Diploma in Taxation Course (DTL) in 100-hours (3 months). The Institute, considering the demanding time slots of working professionals, grants flexible timings to the participants.

Three timing options are provided to the students. In option 1, students can go for 1-hour of session daily. In option 2, students can opt for 2-hours of class on alternate days. Lastly, in option 3, students can choose to take 6-hours of class over weekends.

Conspectus:

Containing various practical aspects of the diploma, the course covers topics such as income tax, TDS, e-filling, GST, and more.

Additional Perks:

- The institute offers a recognized Diploma certificate to its graduates.

- Experienced and practicing Chartered Accountants are the trainers for the course.

- Practical knowledge of income tax, e-filling, GST, etc.

Certificate:

The certification will be proof of the student’s upskills. The recognized certificate will also help the students to get jobs in any commercial organization.

Job Placement and Support:

The Institute of Professional Accountants (Govt Regd.) gives 100% job placement assistance to its alumni.

Course Fees and Duration:

Course Fees: 10,000/-

Course Duration: 24 hours

Address: Vikas Marg Block E Laxmi Nagar, Delhi

Location: Delhi

Website Link: https://the-institute-of-professional-accountants.business.site/

5. Shine Learning

Contact no. – +91 8047105555

Course Specifications:

Advanced Accounting Courses and Certifications are offered by Shine Learning.com for qualifying the students in accounting and taxation courses. Shine Learning is the portal known for providing professional courses and career skills.

Shine Learning was given birth by Shine.com with a vision to up-skill the talented ones of India and making them adaptive to changing job market. The firm partners are many reputed organizations including Vskills, Skillsoft, Digital Vidya, and more.

Conspectus:

The content of Accounting courses covers the topics like auditing, income tax, foreign currency operations, lease contracts, pension funds, and much more.

These advanced accounting courses are for those looking to level up their skills, looking for new opportunities in the finance sector, accounting sector, and certifications in accounting.

Additional Perks:

- Shine Learning.com provides both self-paced and live class learning.

- The organization also gives 24*7 support to its students and participants.

- There are more than 100 partnering firms of Shine Learning.com that hire its graduates.

- The counting of active learners in Shine Learning.com is more than 10k.

- Depending upon the course that students purchase, Shine Learning gives access to study material for six months or one year, or even for a lifetime.

Certificate:

The students will receive certificates from their respective course providers after they complete the course or assignment submission.

Job Placement and Support:

Shine Learning helps its graduates get a job placement. It also helps them build their professional profile on LinkedIn, resume writing, etc.

Course Fees and Duration:

Course Fees: 12999/-

Address: BPTP Park Centra, 11th floor, Jal Vayu Vihar, Sector 30, Gurugram, Haryana 122003

Location: Haryana

Website Link: https://learning.shine.com/

6. Laqshya Institute of Skills Training

Contact No.- +91 8976789830

Course Specifications:

Certified Course in Accounts & Taxation (CCAT) is the course provided by Laqshya Institute of Skills Training. The journey of Laqshya Institute of Skills Training began in 2008 intending to promote technical and non-technical education across Maharashtra.

Laqshya Institute of Skills Training is a Mumbai-based company specialized in the fields of IT, Web services, accounting, finance, taxation, and more.

Duration:

The Certified Course in Accounting and Taxation spans 3 months to 5 months.

Conspectus:

The topics covered under Certified Course in Accounting and Taxation include GST, TDS, basic accounting, Tally, accounts finalization, and much more.

Additional Perks:

- The pieces of training provided by Laqshya Institute of Skills Training are 100% practical.

- To help students experience practicality, they work on live projects.

- Laqshya Institute of Skills Training also provides free notes and study material to its students.

- The trainers for the course are experienced Chartered Accountants.

- Those students who can’t take up weekdays batches can request weekend batches and fast tracks classes.

Certificate:

The certification is offered to the students after they complete the course and submit their assignments. Once the students submit their assignments, they will be scored by their trainers and will receive the course completion certificate.

Job Placement and Support:

Laqshya Institute of Skills Training has its special placement cells for its students. The placement is provided by its clients.

Course Fees and Duration:

Course Fees: INR 8 K – 27 K

Course Duration: 3 weeks-3 months

Address: Off No 9, Bldg.3A, 3rd Floor, Vivina CHS, Super Shopping Centre, NADCO, opp. Railway Station, near Bus Depo, Andheri West, Mumbai, Maharashtra 400058

Location: Mumbai

Website Link: https://laqshya.in/

7. NIMB

The National Institute of Management and Business Studies offered the Business Accounting and Taxation Course in Chennai. It covers all the compulsory modules of accounting and taxation. The course is broken up into six modules, and there are two practical projects to help students learn more about accounting and taxes.

The curriculum is well-organized and put together by industry experts with experience in business accounting courses in Chennai. This makes the institute one of the best places in Chennai to learn about business accounting and taxation. You will get many advantages, including job assistance, a flexible learning schedule, an industry-recognised certificate, live interactive learning, and physical classroom sessions.

8. APG Learning

Students from financial and non-financial backgrounds can take Business Accounting and Taxation Course in Chennai. Students can opt for online or offline mode of training.

The BAT Course in Chennai takes two months and 85 hours of training to acquire all the skills you need to do well in the finance industry. The Accounting courses in Chennai focus on real-life practises so that students can gather real-life experience on tax and accounting tasks.

9. SLA Consultants

Structured Learning Assistant Consultants, also known as SLA consultants, is a well-known IT and non-IT training and development institute that offers the Business Accounting and Taxation course in Chennai. With more than ten years of experience in training, they provide a well-thought-out curriculum that helps you reach your goals and get high-paying jobs in financial accounting.

The course is beneficial because the mentors are experts in BAT and work for multinational companies. The institute also offers personality development training and a job guarantee for students in Accounting Courses in Chennai.

10. Keerti Institute

Keerthi Institute is a well-known institution with intensive training in Business Accounting and Taxation courses in Chennai. This institution helps people take advantage of the enormous potential of the finance field. The course is geared toward the business world and helps people learn about how the finance and tax sectors work. The Accounting courses in Chennai offer 100 per cent placement support for their students.

11. NIFM

The National Institute of Financial Markets (NIFM) is regarded as the best training centre with the best Business Accounting and Taxation course in Chennai. They offer long-term and short-term career-specific courses that help you build your skills and improve your CVs. This institution has both online classes and offline classes.

All of the classes cover topics that are important to the financial industry. There are many courses on the stock market, commodities market, fundamental analysis, technical analysis, debentures, share market, derivatives market, forex market, and more.

They have up-to-date modules so students can learn the concepts and get the right kind of hands-on training. It gives you a perfect way to know so that you can pick up the best BAT Course in Chennai.

Trivia Facts:

Now that you have a list of courses to choose from, let me share quick facts about accounting and taxation with you.

1. Do you know how the practice of bookkeeping and ledger get started?

Luca Pacioli, an Italian mathematician, wrote a 615-page book published in 1494 that contained details on the double-entry bookkeeping method.

He was the first person who shares insightful details on accounting, thus becoming the ‘Father of Accounting.’

2. How the practice of accounting and commerce came to India?

The man who pioneered accounting and commerce practice in India was Shri Kalyan Subramani Aiyar. He pioneered commerce and accounting practices in India by establishing courses and educational institutions dedicated to this industry. K. S. Aiyar is known as the Father of Accountancy in India.

After scrutinizing this listicle, I hope that you must have found the Accounting and Taxation course in Chennai that suits you the best.

So, what are you waiting for? Enroll yourself in the best Accounting and Taxation course in Chennai and hone up your accounting skills. Remember, the right choice, of course, will take you up the ladder of success. For now, I, your author, am signing off! And, wishing you a successful career!

P.S. Hey! Do not forget to go through FAQs for little more knowledge.

Business Accounting And Taxation Course: Best Institutes | Scope

Recommended Reads

- Top 10 Business Accounting and Taxation (BAT) Courses Online

- Top 10 Business Accounting And Taxation (BAT) Courses In Delhi

- Top 10 Business Accounting and Taxation (BAT) Courses in Mumbai

- Top 10 Business Accounting And Taxation Course in Bangalore

- Top 10 Best Business Accounting and Taxation (BAT) Courses in India

FAQ’s

Q1. What are the technological trends in accounting and taxation?

Ans. Some technological trends in accounting and taxation include adopting online software solutions, AI, ML, cloud-based software systems, blockchain technology, and much more.

Q2. Which are the job opportunities that I can tap into after completing the certification course?

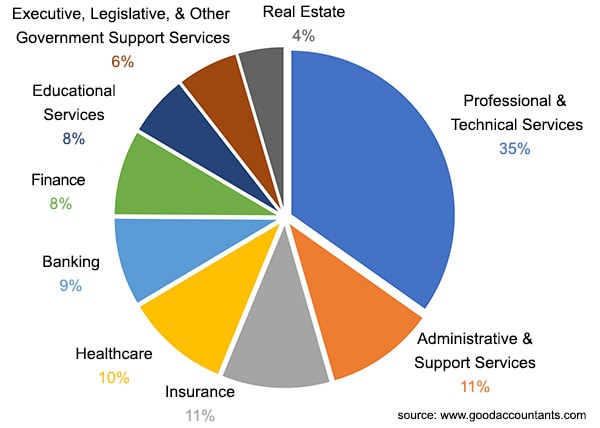

Ans. After earning the certificate you can apply for professions in various sectors. Such as healthcare, finance, real estate, banking, insurance, etc. Earning the certification course in accounting and taxation opens a wide door for you.

Q3. What is the importance of the accounting and taxation course?

Ans. There are many benefits of the accounting and taxation course. The major ones are:

a. Better job opportunities.

b. Non-commerce graduates can also find a career path in accounting.

c. There’s a great demand for accounting professionals in the market.

d. You will gain practical knowledge.

Q4. How will the Accounting and Taxation Course affect my Pay Scale?

Ans. Your salary varies as per the profession you choose. Below I have inserted a graph image to help you get an estimated idea of salaries

Recommended Programs

Income Tax Specialist Course

by Henry Harvin®

100% Practical Income Tax Course| India's Best Certified Income Tax Course | Henry Harvin® Featured by Aaj Tak, Hindustan Times | Income Tax Course Training By Award-Winning Speakers | 2,665+ Income Tax Professionals Trained | Interactive Instructor-led Classes.

Accounting and Taxation Course

With Training

The Certified Accounting and Taxation Course (CATP) covers critical components of Accounting like GST, Income Tax, and TDS which have a crucial bearing on the modalities of Financial business operations in India. The CATP course is earmarked for professionals keen on building a successful career in Accounting and Taxation.

Best Advanced Excel Training &

Certification Online

No. 1 Ranked Advanced Excel Course in India | Trained 5,935+ Participants | Get Exposure to 11+ projects | Learn to Apply Advanced Formulas, Perform Data Analysis & Data Visualization, and Create Pivot Tables & Dashboards| Live Online Classroom Core and Brush-up Training Sessions

Tally Prime Course Course

Get Practitioner Certification

Tally Prime, the latest Tally Software used in Accounting, Taxation Software, Accounts Receivables, Accounts Payable, Inventory, Billing, and Payroll | Use Tally Prime to Calculate TDS, Income Tax, and GST | Earn a Rewarding Certification of Certified Tally Accountant (CTA), from Henry Harvin, the Award Winning Institute

Explore Popular CategoryRecommended videos for you

Online Accounting & Taxation Course Tutorial /p>

Online Accounting & Taxation Course Tutorial

Introduction to MS Excel | Best Advanced Excel Full Course

Advanced VBA - Like Operators VBA | Best Free Advanced Excel

GST Practitioner Course | GST Training

Best GST Practitioner Training

Introduction To Income tax Specialist Course

Income Tax Course Tutorial for Beginners

Tally ERP 9 Course Tutorial For Beginners

Tally ERP 9 Course Tutorial For Beginners