Table of Contents

What is IFRS?

IFRS Institutes In Bengaluru: Accounting professionals have to study meticulously for numerous years in India to get certified. The final examination of chartered accountancy, in particular, can be a tough nut to crack. After passing CPT many students fail to pass both the Common Proficiency Test and the Integrated Professional Competence Course in a single attempt. This means that even though the CA course duration is roughly 4-and-a-half years, students struggle and take much longer to clear both.

But for those on the other side of the chasm, those who have successfully passed both certifications and become working professionals, the IFRS certification is like a godsend. This certification vaults candidates completing the IFRS certification into pole position and top dog in the accounting world.

But hang on there. IF…. what S? Don’t be surprised if the term has you stumped. For many in the non-accounting and non-finance world, the term IFRS just doesn’t ring a bell. Let’s clear that misconception right away.

IFRS is a moniker for International Financial Reporting Standards, which are accounting standards issued by the IFRS Foundation and the International Accounting Standards Board (IASB).

IFRS institutes in Bengaluru

In recent years, the city of Bengaluru has become a hub for those wishing to pursue CA, IFRS or other accounting certifications. This is because the job prospects and salaries are much better for those with these certifications in Bengaluru than elsewhere.

So, without much further ado let’s jump in and have a sneak peek at institutes offering IFRS certifications in Bengaluru and what they offer to accounts students.

1. Henry Harvin Institute

This institute is the top dog when it comes to institutes offering quality IFRS certifications in Bengaluru.

The institute offers 60 hours of live virtual training, one-year free brush-up sessions and E-Learning access. The E-learning access is availed through a one-year membership which provides access to recorded videos, games, projects, case studies etc. Training is done by experienced industry mentors with more than 10 years of experience. Also, during the training live projects are provided which exactly mirror real-world projects in the industry. Upon completion of the course, an internship is guaranteed by Henry Harvin or partner firms.

Henry Harvin’s IFRS course

Finance professionals need to follow and learn the accounting norms in the Ind-AS framework. This has made Henry Harvin design an IFRS training program that will benefit participants to know the structure of the IFRS framework and implement proper financial reporting standards to important aspects of financial reporting.

The Henry Harvin IFRS certification develops knowledge about IFRS. Students are trained as to how to apply these standards, what are the theories, concepts and principles underpinning IFRS as well as their application both in India and globally.

The Henry Harvin IFRS course covers the International Accounting Standards along with IFRS.

The institutes 60-hour training will enhance students understanding of global accounting standards and use them in preparing financial statements such as Statement of Financial Position, Statement of Equity, Income Statement, and other comprehensive income statements.

Henry Harvin’s IFRS course ensures that participants learn about general-purpose financial reporting and understand IFRS-based financial statements. Students will also hear about the principles of accrual-based accounting, capital and capital maintenance, as well as the principle of objectives, measurement bases and disclosures of IFRS and IAS standards.

Henry Harvin’s training methodology

Students undergo live projects during the training tenure to develop experiential learning. This helps in better understanding of concepts and getting in-depth practical insights. The institute also uses a mix of techniques aligned to its unique G.C.A.O pedagogy. This enables students to get focussed action-oriented outcomes from the training. Lastly, students will be engaged throughout the training through reverse presentations, group activities, brainstorming sessions and hands-on experience statistical and non-statistical tools with a focus on value creation.

Benefits of IFRS with Henry Harvin

Some of the benefits of doing an IFRS course with Henry Harvin include:

A virtual tour of strategies, principles and implications through 60 hours of online and offline training.

One-year membership of Henry Harvin’s Finance Academy.

Free monthly brush up sessions.

Study material.

Access to the Learning Management System.

Recorded videos of the sessions.

100% placement, internship and project support exclusively for IFRS participants.

Excellent knowledge of global accounting standards and the opportunity to work in renowned companies.

The costing of IFRS with Henry Harvin depends on the type of instruction given. For self-paced learners, the fee is INR 13,500 and for live online training, the course fee is INR 15,000.

Cities in India Where Henry Harvin Course in Provided:

Bangalore, Chennai, Gurgaon, Kolkata, Mumbai, Jaipur, Hyderabad, Lucknow, Chennai, Gurgaon, Kolkata, Pune

Other Henry Harvin Courses:

ACCA Course, Financial Analytics Course, Financial Modeling Course, RPA Certification Course

Henry Harvin® IFRS Course Ranks #1 in India by The Tribune

Also Check this Video:

2. PwC Academy

ACCA’S diploma in IFRS in Bengaluru by PwC’s Academy certifies finance and accounting professionals to become IFRS certified. PwC’s Academy is an education service offering of PwC India. It provides many training courses based on the best practices of PwC’s global network of firms and brings real-life business experience into the classroom.

Apart from Bengaluru, PwC’s IFRS program is also conducted in Mumbai, Pune and Chennai. The diploma is an IFRS certification certified by the Association of Chartered Certified Accountants, the leading global accounting body involved in the development of IFRS.

Upon completion of the course participants will receive an internationally recognised ACCA DipIFR certificate; an in-depth understanding of the principles and rules of IFRS; knowledge of the specific requirement of IFRS for the recognition, measurement, presentation and disclosure of financial statements, skills in the preparation of financial statements under IFRS, including consolidated financial statements; experience in arriving at a professional judgement on the practical application of IFRS; in-depth training on new revenue and leasing standards (IFRS 15&IFRS 16) with industry-specific examples.

Participants will also be provided with training material developed by PwC’s global methodologists. Classes will be conducted by experienced instructors who have worked with leading organisations around the world and advised them on complex financial and reporting problems.

Ind AS concepts will be covered as part of the curriculum, and access to PwC’s proprietary training materials.

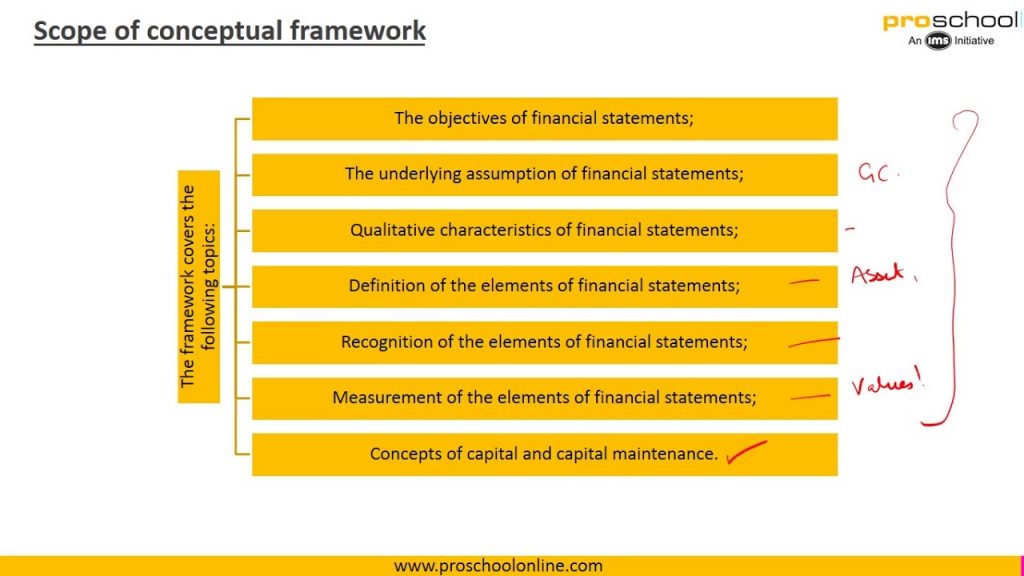

The ACCA DipIFR course curriculum includes a conceptual framework for financial reporting, presentation of financial statements, business combinations, investments in associates and joint ventures, impairment of assets, provisions for contingent liabilities and contingent assets, IFRS for small and medium-sized entities, the effects of changes in foreign exchange rates, revenue from contracts with customers, accounting for government grants and disclosure of government assistance, non-current assets held for sale and discontinued operations, etc.

The course fees for IFRS with PwC comes to INR 32,500, and covers all necessary study material but excludes exam registration fees payable to ACCA as well as taxes.

3. Ernst And Young IFRS course

Ernst and Young are one of the big four accounting firms in the world and as such, it is one of the best places to get certified for accounting programs.

Ernst and Young’s IFRS certification is a 16-Sundays program after the completion of which certificates can be issued.

The course comprises 75 hours of classroom training with 8 classroom sessions of 8 hours of training each and 11 hours of recorded videos.

All instructors and trainers are people who have worked in the top management of companies as managers and directors

Benefits of Ernst and Young’s IFRS course

While undergoing training students receive comprehensive study material from Becker Professional Education, an ACCA-approved content provider, a comprehensive question bank with solutions from Becker Professional Education, Ernst and Young presentations, a one-year access to the Learning Management System, access to the EY virtual academy after the completion of the program.

Curriculum

Ernst and Young’s IFRS curriculum includes the presentation of financial statements, accounting policies, changes in accounting estimates and errors, income taxes, property plant and equipment, accounting for government grants and disclosures of government assistance, borrowing costs, investments in associates and joint ventures, intangible assets, first-time adoption of IFRS, share-based payment, non-current assets held for sales and discontinued operations, financial instruments and disclosures, Ind-AS details, statement of cash flows, events after the reporting period, related-party disclosures, interim financial reporting, fair value measurement etc.

Course fees include INR 30,000 plus applicable taxes. Those who wish to appear for the diploma in IFRS exam conducted by ACCA have to pay GBP 185 directly to ACCA.

4. KPMG Training on ACCA’s IFRS Certification Course

The Association of Chartered Certified Accountants(ACCA) has launched a diploma in IFRS in conjunction with KPMG as a gold learning provider for this program, in Bengaluru as well as in other locations. A certificate of participation will be given to all students enrolled and having more than 90% attendance.

The program is based on the Diploma in IFRS syllabus of ACCA and aims to prepare participants for the diploma IFRS exam conducted by ACCA. The program covers 75 hours of intensive and interactive online as well as classroom training with the sessions being held on the weekends.

Apart from emphasizing the features of IFRS the course also aims to alert students to the differences between IFRS and Ind AS and Indian GAAP wherever possible.

Mock examinations and tests will also be conducted to prepare the students for the final exam.

Features OF KPMG IFRS

Students will be provided access to the Learning Management System for a year from the date of batch commencement. This includes session presentations, a summary of standards, session videos, modules on differences between IFRS, Ind-AS and Indian GAAP.

Curriculum

The KMPG IFRS course aims to enlighten participants to understand and explain the structure of the framework of international accounting, apply relevant financial reporting standards to key elements of financial reporting, identify and apply disclosure requirements for companies in financial reports and notes, and prepare group financial statements including subsidiaries, associates and joint ventures.

Program Eligibility

Professional accountants and auditors working in a practice or business, and who are qualified according to national accounting standards, are eligible to take the ACCA IFRS certification course. Working professionals who are not qualified may still be eligible to partake in the course. Such individuals will need to prove three years of relevant accounting experience with a duly filled, signed and stamped ACCA certification by the employer or a relevant degree with three years of work experience.

The program is chiefly aimed at CFOs, finance directors and strategic planners, accountants and analysts, consultants, CAs and CMAs, and finance and accounting professionals with an MBA in finance. However, graduates and postgraduates who are part of a finance or accounting team can also apply.

To clear the final exam candidates have to sit for a three-hour written exam, which is held two times a year – in June and in December- at ACCA’s exam centres in India. The exam consists of two sections and is a combination of calculations and written answers with some questions adopting a case study approach. The passing percentage is 50%.

Successful candidates are awarded the Diploma in IFRS certification by KPMG and ACCA.

The course fee, excluding GST, is INR 32,608. This includes study material but excludes the exam registration fees which are payable to ACCA.

5. PROSCHOOL

One of the leading institutes in Bengaluru offering the IFRS certification, amongst others, is Pro School. The certification is offered jointly by NSE Academy, NSDC and IMS Pro School.

Curriculum

The comprehensive syllabus of Pro School includes a structure of the IFRSF/IASB, extant standards of the IASB, the use of IFRS around the world, the IASB roadmap, the annual IASB bound volume, revenue from contracts with customers, accounting policies and changes in accounting estimates and errors, property plant and equipment, investment property, impairment of assets, borrowing costs, inventories, leases, non-current assets held for sale and discontinued operations, etc.

The methodology of training followed is both classroom training as well as live online training. The classroom program is a 3-month training program for IFRS on weekends. Books and other study material are provided here. The program has been designed and is being taught by faculty with real-life expertise. The all-inclusive course fees for this program is INR 32,000.

Live online training involves 55 hours of live interactive training, another 15 hours of online tutorials, study materials and recorded sessions, doubts clearing sessions face to face with experts and course fees of INR 25,000 (all-inclusive).

6. GLOBAL FTI

Global FTI’s ACCA diploma in IFRS builds on the technical and practical knowledge acquired from recognised country specific accountancy qualifications or relevant work experience. Its syllabus introduces candidates to the wider international accounting framework and standard-setting system.

The course emphasises on the application of conceptual or technical financial reporting knowledge that participants have obtained before the course to the specific requirements of financial reporting under international financial reporting standards.

Curriculum

The ACCA Diploma in IFRS covers international sources of authority, elements of financial statements, presentation and additional disclosures, preparation of external financial reports for combined entities, associates and joint arrangements.

The course offers 60 hours of live, interactive classroom training, conducted by GFTI’s experienced ACCA faculty and also study material from ACCA approved publishers.

Examination format

GFTI’s ACCA diploma in IFRS comprises a single three-hour written exam. The passing percentage is 50%. The paper comprises two sections which require a mix of calculations and written answers. The assessment marks are split in two. Section A comprises one group’s question for 40 marks. Section B comprises three scenario/ case study questions of 20 marks each consisting of a total of 60 marks.

The examination is held twice a year in June and December at ACCA’s examination centres.

Fees

The tuition fees for GFTI’s ACCA certified IFRS course is INR 20,000 plus taxes.

The fee to be paid to ACCA for new applicants is GBP 206. This is valid for one exam attempt. For resetting for the exam another payment of GBP 206 is required.

7. iBAS Global

iBAS Global is a global education institution headquartered in Bengaluru devoted to excellence in teaching, learning and unleashing leaders in business who work on accomplishing sustainable and visionary goals for all stakeholders, including society at large.

While earlier iBAS’ focus was skill development by providing short-term courses, today, keeping in mind the changing landscape and requirement for professionally qualified professionals, it has expanded its portfolio to provide several excellent finance and accounting courses, including IFRS.

The student base of iBAS Global has expanded to include 40 companies,15 colleges, five universities, and seven countries. The company’s ex-students are well placed in global MNCs.

The company’s expertise lies in the designing, development and delivery of certified programs that create value addition to students who may be already pursuing professional or graduate courses.

Curriculum

iBAS’ curriculum for its IFRS course includes introduction and overview of regulatory issues and recent changes, presentation and disclosure issues, accounting for assets, accounting for liabilities, accounting for financial instruments, other issues in IFRS accounting, accounting for groups, first-time adoption of IFRS, recent issues and possible future changes.

The course provides participants with a complete overview leading to the proficiency of the requirements of IFRS, how these changes in accounting practise need to be recognised and other issues relating to accounting and reporting of financial statements. The participants will gain a good idea of the different types of IFRS and gain an understanding of the issues surrounding these standards.

The target audience of the course

iBAS’s IFRS course is primarily aimed at consultants practising CA, CS, and CWS; faculty of finance and business schools; accountants, analysts, auditors and tax directors, investment bankers, corporate bankers; private equity and mergers and acquisitions specialists; CFO’s, finance directors and strategic planners.

Learning Methodology

The learning methodology will include a mix of the introduction of key concepts through the “teaching and discussion” method; the use of source material of authors and practitioners in this area to support concepts and establish references to existing practices; the use of extensive examples from different countries with different experiences to illustrate the points taught; the use of short exercises to provoke and consolidate concepts introduced, and the use of major case studies – to apply tools and to illustrate in detail some of the key points of the workshop.

Course duration and delivery

The course consists of 48 hours of training conducted over 12 Saturdays from 8 am to 12 pm. In addition to weekend classes, an extra six hours of support are delivered through the week to assist students to complete the assignment and obtain clarifications on the syllabus covered in weekends. Live classes will be recorded and given to students.

Fees and examinations

The coaching fee charged by iBAS Global is INR 26,000. The exam fee charged by ACCA UK for diploma in IFRS is a student registration fee of INR 8900 and DipIFRS exam fee of INR 11,700.

The diploma in IFRS at iBAS is assessed by a three-hour written exam held twice a year with a pass percentage of 50 per cent. This year the exam will be held on 11 June 2021.

8. CFO NeXT

CFO Next has hands-on experience in imparting the skills and knowledge of profit or loss, assets, inventories, investments, accounting policies, financial instruments, operating segments, share-based payments, liability accounting, lease and revenue management.

CFO NeXT is a gold approved learning partner of ACCA UK and is highly recognised in Bengaluru for providing training for professional accounting certifications taught by experts providing exceptional IFRS training to help candidates crack exams, achieve career advancement and get employment opportunities in renowned audit firms.

Eligibility

Professional accountants or auditors working in a practise or business and qualified according to national accounting standards are eligible. Those working in practice but not yet qualified are conditionally eligible. Such candidates have to prove two years of relevant accounting experience and a relevant degree (attracting at least ACCA qualification exemptions F1-F4), and two-or-three years relevant accounting experience and ACCA affiliate status.

Course Curriculum

CFO NeXT’s IFRS course covers international sources of authority, elements of financial statements, presentation and additional disclosures, preparation of external financial reports for combined entities, associates and joint arrangements, etc amongst other features.

Classes are scheduled for 10 weekends and include 60 hours of live, interactive classroom training conducted by CFO NeXT’s experienced faculty and study material from ACCA approved publishers.

Course objectives

Upon completion of the course candidates should be able to understand and explain the structure of the international professional and conceptual framework of accounting, apply relevant international financial reporting standards to key elements of financial reports, identify and apply disclosure requirements for entities relating to the presentation of financial reports and prepare group financial statements.

Examination and fee details

CFO NeXT’s diploma in IFRS is a three hour written exam and candidates will need to achieve 50% or above to complete the paper. The exam is held twice a year in June and December at ACCA’s centres.

The examination consists of 2 sections: a One groups question of 40 marks and three scenario questions of 20 marks each.

As far as fees are concerned new applicants have to pay a standard entry fee of GBP 185 and a fee of GBP 299 for a late entry. The fee covers both coaching fees as well as exam fees.

9. Manipal ProLearn

Manipal ProLearn offers EY & MAHE Advanced certificate in IFRS that will equip participants with the knowledge of assets, investment, inventories, accounting policies, operating segments and financial instruments. The curriculum is designed under the guidance of industry experts and is sourced from BECKER, the approved publisher of learning material from ACCA, UK.

Manipal ProLearn’s IFRS certification is designed to help candidates to better understand IFRS. The course is in sync with ACCA’s diploma in IFRS. Upon successful completion of the IFRS course in Bengaluru, candidates will be issued a joint certification from Manipal ProLearn and EY

Eligibility

People who are qualified as CAs, CSs, ICWAs working in the accounting domain or those possessing an MBA in finance and working in the accounting domain, chartered accountants, company secretaries, ICMAs, and other finance professionals, Finance managers, chief accountants, private equity and M&A professionals, and graduates working in finance/accounting domain are eligible to apply for this course.

Learning Objectives

Upon completing the course candidates will learn the structure of the framework of IFRS, use the right financial reporting standards in financial reports, understand accounting standards in

the IFRS, Ind-AS framework and related practical application issues, prepare group financial statements

that cover subsidiaries, associates and joint ventures identify and apply disclosure requirements.

Check for- Accounting and Taxation Certification Course

Curriculum

The course curriculum includes varied topics such as property, plant and equipment revenue; borrowing

costs, revenue from contracts with customers; impairment of assets, construction contracts; intangible

assets, provisions, contingent liabilities and contingent assets; investment property; agriculture/

consolidation, etc.

Teaching methodology

Manipal ProLearn’s hands-on training is delivered via webinars, video tutorials, assessments, practise

exercises and real-time case studies. This is valid for classroom teaching. Additionally, Manipal ProLearn

also offers online coaching, live training through webinars, where candidates can clear doubts and queries with experts online.

The training consists of 200 hours of a comprehensive and modular set of learning content. Learners will get access to videos by experienced accounting professionals from the Indian version firm of EY global.

Upon successful completion of the assessment, candidates will be awarded a joint certificate from Manipal ProLearn and EY. For those appearing for ACCA certification, a separate exam is held twice and year and candidates successfully passing that exam are awarded a Diploma in IFRS by ACCA.

The course fees for classroom training is INR 25,700 and the online instructor-led course fee is INR 35,400.

What does IFRS represent?

They represent a standardised way of describing a company’s financial performance so that company financial statements are understandable and comparable globally. The IFRS are particularly relevant for companies who have shares or securities listed on a public stock exchange.

IFRS financial statements consist of

a statement of financial position (balance sheet)

a statement of comprehensive income

a statement of changes in equity

a statement of cash flows

notes, including a summary of the significant accounting policies.

Relevance of IFRS

IFRS Standards are required in more than 140 locations in many parts of the world, including India, Pakistan, Hong Kong, Australia, Malaysia, South Korea, Singapore, Philippines, Brazil, Chile, the European Union, Russia, GCC countries, Kenya, South Africa, and Turkey.

IFRS have replaced different national accounting standards globally. However, in the United States, the standards used are called General Accepted Accounting Principles (GAAP) and these are used in place of the IFRS standards. The Securities Exchange Committee (SEC) in the United States requires the use of US GAAP by American companies, which are listed on stock exchanges and does not permit them to use IFRS. GAAP is also used by some companies in Japan.

Since the implementation of IFRS gained acceptance, approximately 29,000 domestic listed companies on 93 major securities exchanges spread over 100 countries in the world use IFRS standards.

Benefits of IFRS for Companies

The main advantage of IFRS is it allows the comparison of different companies, as data is presented on the same basis. This allows for easy comparison of data.

With a single set of accounting framework, the understanding of accounting procedures can be broken down from its complexity to a standard procedure. So IFRS reduces complexity in accounting.

IFRS works on a principle-based philosophy rather than a rule-based philosophy. IFRS also makes sure that the complete and relevant information is present in the financial statement, always providing a transparent picture with the least scope of manipulation.

With increased exposure to global markets, access to foreign companies has become easier. This has resulted in an increasing trend of consolidation with more foreign capital entering India in the form of acquisitions and mergers with bigger brands and multinationals.

With a framework that everybody can understand globally, financial statements are more recognizable for investors and potential collaborators, which brings about trade on a global level.

Prompt deliverance of financial data, automation reducing time taken and reduced cycles of reporting are some of the other benefits of IFRS.

IFRS reporting also leads to an improvement in the quality of regular reporting and an improvement in the scope of planning and forecasting revenues of the company.

As far as Indian companies are concerned IFRS influences the direction of convergence, is used by foreign subsidiaries of Indian companies, stimulates questions from investors comparing Indian companies to foreign competitors, and influences the transaction structuring by foreign counterparties (customers, vendors and capital providers) who report under IFRS.

Benefits of IFRS for individual employees

In India, there is a growing demand for IFRS professionals as more firms migrate to these standards. Hence, finance and accounting professionals who want to outshine the competition need to take up this certification.

Finance professionals equipped with IFRS certification have an inherent advantage over professionals from the same field who don’t have this certification as they know international accounting standards.

The IFRS certification makes one eligible to work in more than 100 countries worldwide.

As IFRS guidelines constantly change and evolve, there will be increasing demand for IFRS professionals.

Having this certification leads to a pay hike of 30-40% over the long term, as compared to individuals who don’t have this certification.

Industries with high demand for IFRS certification

In India implementation of IFRS guidelines began in 2011 for companies who were not in the insurance, banking and non-banking sectors. For smooth operational transitioning a large number of IFRS individuals are needed.

Advisory companies offering advisory services to finance and accounting firms need to hire IFRS professionals as consultants. Ditto for audit firms.

There is a high demand for IFRS professionals within India in the banking and insurance sectors.

Skilled and experienced IFRS professionals can offer private consultancy for firms and increase their income.

The need for skilled IFRS professionals has also been seen in the financial education industry as institutes which offer IFRS certifications need experienced IFRS practitioners to teach their students.

Conclusion

In sum, the IFRS certification can certainly be a shot in the arm and provide a good boost to your career. However, timing, knowing the right moment in life to undergo it as well as choosing the right institute can make all the difference between getting the right certificate which can propel you in your career or falling by the wayside in this ultra-competitive world. Happy learning!

Recommended Reads:

- Top 9 IFRS Certification Course in Mysore

- Top 10 IFRS Courses In Ahmedabad with Scope, Eligibility & Duration

- Top 10 IFRS Course Institute in Indore with Syllabus & Fees

- Top 10 IFRS Certification Courses in Bangalore with Scope & Jobs

- List of International Financial Reporting Standards

FAQs

Who can do IFRS?

IFRS is designed keeping in mind professional accountants and auditors who are qualified in their national accounting standards and who need to update their skills to meet the challenges involved in adopting and implementing IFRS in their workplace. An educational or vocational background in financial reporting is recommended before starting the IFRS certificate. This course also immensely helps ACCA members who gained their qualifications before the introduction of IFRS.

Why do companies use IFRS?

IFRS Standards address the challenge of a lack of skilled professionals by providing high quality, internationally recognized set of accounting standards that bring accountability, and efficiency to financial markets around the world.

IFRS Standards bring transparency by enhancing the international comparability of financial information, enabling investors and other market participants to make informed economic decisions.

IFRS Standards strengthen accountability by reducing the information gap between the providers of capital and the people to whom they have entrusted their money. As a source of globally comparable information, IFRS Standards are also of vital importance to regulators around the world.

IFRS Standards contribute to economic efficiency by helping investors to identify opportunities across the world, thus improving capital allocation. For businesses, the use of a single trusted accounting language lowers the cost of capital and reduces international reporting costs.

What are the advantages and disadvantages of IFRS?

Advantages:-

It would create a single set of accounting standards around the world.

It would reduce the time, effort, and expense of preparing multiple reports.

It would make it easier to monitor and control subsidiaries from foreign countries.

It would offer more flexibility in accounting practices.

It would make it easier for all companies to do business in foreign countries.

It would help to streamline the system by creating one centralized authoritative body.

It would create a higher return on equity.

It would improve the rates of foreign direct investment around the world.

It would be helpful to newer investors and smaller investments.

Disadvantages:-

It would increase the cost of implementation for small businesses.

It would lead to concerns with standards manipulation.

It would require global consistency in auditing and enforcement.

It would increase the amount of work placed on accountants.

It would require changes at the educational level as well.

It would still require global acceptance to be useful.

What are the challenges of IFRS?

Several challenges will be faced on the way to IFRS convergence. They are:

a. The difference between GAAP and IFRS:

The adoption of IFRS means that an entire set of financial statements will need to undergo a drastic change. The differences are wide and deep. It would be a challenge to bring about awareness of IFRS and its impact on the users of financial statements.

b. Training and education:

A lack of training facilities on IFRS will also pose challenges in India. There is a need to impart education and training on IFRS and its application.

c. Legal consideration:

Currently, the reporting requirements are governed by various regulators in India and their provisions override other laws. IFRS does not recognize such overriding laws. The regulatory and legal requirements in India will pose a challenge unless it has been addressed by regulatory authorities.

d. Taxation effect:

IFRS convergence would affect most of the financial statements and consequently, the tax liabilities would also change.

e. Fair value measurement:

IFRS uses the fair value as a measurement base for valuing most of the items of financial statements. The use of fair value accounting can bring a lot of instability and prejudice to the financial statements. It also involves a lot of hard work in arriving at the fair value.