Table of Contents

IFRS (International Financial Reporting Standard) can be defined as a globally accepted language commonly used for describing business accountancy. In simple words, one can quote these as the accounting standards give out by (IASB) International Accounting Standards Board and the IFRS Foundation. This article highlights the top 10 IFRS Certification course in Indore and the list of IFRS Standards.

IFRS provides the international standards and general guidelines for companies to follow on how to prepare or disclose financial statements of their company to the Public. Following a single set of globally recognized standards means using the same language and style when reporting. This simplifies accounting procedures. It also gives auditors and investors a cohesive understanding of finances.

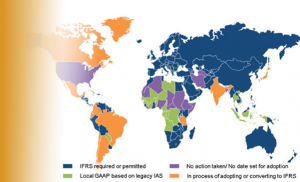

Currently, 130+ countries have adopted IFRS that includes the UK, Canada, Nigeria, Australia, European Union Saudi Arabia and more. Acceptance of list of IFRS standards worldwide has opened up career opportunities for many individuals.

List of Top 10 IFRS Courses in Indore

Indore as a City

Indore is one of the most developed cities in Madhya Pradesh, often known as an Educational Hub of the state. It is a center of learning and education and homes many good and recognized schools and universities. This city is a good choice for students who are looking to pursue value-based learning and education.

1. Henry Harvin®

One of Henry Harvin® courses – the IFRS certification course has been ranked to be the Top 2nd course in the Finance industry by Trainings360. Henry Harvin offers 2 IFRS related courses. One is the IFRS certification course and the other is a Diploma course. The IFRS certification course of Henry Harvin has benefited more than 8,000 Finance Professionals’ in their careers to reach their goals. This certification course

- Develops and advances knowledge about the list of IFRS Standards and how to apply and use these principles and theories in the Indian and global market.

- This certification course covers not only the IFRS (International Financial Reporting Standards) but also the IAS (International Accounting Standard).

- The Henry Harvin’s IFRS certification course helps train aspirants to ascend their understanding of international accounting standards and learn how one should use these standards for preparing financial statements such as Statement of Equity, Statement of Financial Position, Income Statement etc.

- Henry Harvin’s IFRS certification course also certifies that the candidate is well-versed about the principles of accrual-based accounting in general-purpose financial reporting and understands the IFRS-based financial statements.

Course Highlights

- Develop ones’ knowledge on the list of IFRS standards

- Sixty hours of Training both Classroom and Online

- Experienced and High-quality trainers with 10 years+ experience from the industry.

- Alumni from Tier 1 colleges such as 12+ IIM’s and 7+ IIT’s and in top-notch companies like Abbott Pharma, NTPC, Apollo Tyres, SAB Miller, Fidelity Investments, Deloitte, IBM, HP, Acce etc.

- Job opportunities through a network of MNCs and TNCs. 10+ new job opportunities are posted every week.

- One year access to premium content in Henry Harvin Finance Academy that includes Videos, case studies, projects, and Brush-up Sessions

- Guaranteed Internship either with Henry Harvin or with firms partnering with it.

- Working on live projects as a part of training

- The course is targeted for financial professionals, in particular in accounting who need to learn the IFRS fundamentals and know the list of IFRS standards, why the IASB developed these standards and implementations in 100+ countries around the world.

The second course offered by Henry Harvin is the Diploma course. This course is more advanced and targets mid-career and senior financial professionals who are looking to learn the IFRS standards in-depth. The diploma course builds detailed knowledge about the IASB’s Conceptual Framework for Financial Reporting. Graduating professionals have the ability to prepare financial statements for group entities, identify disclosure needs, and ensure that the list of IFRS standards is applied correctly to all sections of the entity’s financial statements. Only professionals who are qualified as per accounting standards of the nation have the eligibility for this course.

Henry Harvin has a unique methodology of training that has been proven to be extremely effective over and over again in the thousands of students who have graduated from our programmes. Along with live projects for practical knowledge. Henry Harvin teaching leverages a blend of approaches uniquely aligned to the GCAO pedagogy. This teaching methodology allows students to create goal-specific action-oriented results from the programme. Throughout the course, students will be end-to-end engaged by leveraging reverse presentations, brainstorm forums, hands-on use of statistical and other tools to double down on creating value.

Cities in India Where Henry Harvin Course in Provided:

Bangalore, Chennai, Gurgaon, Kolkata, Mumbai, Jaipur, Hyderabad, Lucknow, Chennai, Gurgaon, Kolkata, Pune

Other Henry Harvin Courses:

ACCA Course, Financial Analytics Course, Financial Modeling Course, RPA Certification Course

Henry Harvin® IFRS Course Ranks #1 in India by The Tribune

Also check this video:

2. KPMG Learning Academy

KPMG, a leading provider of internal audit, financial advisory, tax and regulatory services and corporate governance offers the IFRS certification. KPMG’s Diploma in IFRS by ACCA is planned to prepare aspirants to learn and work with the latest international accounting practices. KPMG is an official ACCA Approved Learning Provider with a rich pedigree in successfully preparing 35+ batches of students for the Diploma in IFRS examination.

The KPMG training programme gives candidates a comprehensive conceptual understanding of IFRS. About 9000 aspirants from across many corporates have trained successfully for IFRS Certification course under KPMG. The programme lays emphasis on assisting companies to achieve a smooth changeover from GAAP to IFRS

Course Highlights

- The programme includes 75 hours of training that is high intensity and extremely interactive. The physical sessions are held on weekends, there are also online options available.

- Develop ones’ knowledge on the list of IFRS standards

- Access to the Learning Management System is provided for a year from the start of the batch. This premium material includes session videos and presentations, the list of IFRS standards, Modules stating difference between IFRS/ Indian GAAP / Ind AS

- Experienced professional trainers from KPMG, India

- Mock examination and test are conducted and monitored. This enables far superior results for this programme.

The training provided by this programme develops a deep knowledge of IFRS built upon a strong foundation of the principles and underlying concepts. It then applies these concepts to both Indian and international contexts preparing students for a wide variety of local and global opportunities.

3. IFRS Training by Ernst & Young

Ernst & Young is recognized amongst the top four accounting firms globally. Their Certification course in IFRS is planned based on the syllabus of ACCA’s “Diploma in IFRS” certification course. Objective of this course is to take the candidates through all topics covered. This will help them prepare for the Diploma in IFRS exam conducted by ACCA. Furthermore this course covers main differences between IND-AS and IFRS in each module.

Course Highlights

- Seventy-five hours of training

- Develop ones’ knowledge on the list of IFRS standards

- 6 hours every day, of 10 interactive sessions

- Recorded videos

- Comprehensive course material from ACCA approved Becker Professional Education.

4. Synthesis Learning

Synthesis Learning, a training institute prepares graduates, undergraduates and professionals for international professional qualifications like Diploma in International Financial Reporting (DipIFR). This is ultimate for any finance professional who wants to gain a good understanding of International Financial Reporting Standards (IFRS).The training program is created as per the syllabus given by the ACCA (Association of Chartered Certified Accountants) .This Diploma in IFRS, which is regarded globally and well-recognized.

Course Highlights

- Deliver high standards of learning and development.

- Develop ones’ knowledge on the list of IFRS standards

- Help seek Job opportunities and Internships through a network of MNCs and TNCs

- Online and Classroom trainings in “Multiple Locations” across Mumbai, Ahmedabad and Indore.

- High quality trainers who are themselves “Experienced Professionals” from the finance industry.

- Experimental Learning – a rare blend of theoretical & practical learning.

5. Global Computer

Global Computer Education is a leading business in Indore. It offers professional training and specializes in preparing aspirants for IFRS certification course in Accounting and other courses like programming languages, web designing, hardware and networking. The IFRS certification course emphases on imparting training in accounts and finance and ensure that candidates upgrade their skillset.

Course Highlights

- Deliver high standards of learning and development.

- Develop ones’ knowledge on the list of IFRS standards

- E-learning and Classroom trainings

- Experienced trainers

6. NIIT Imperia

The National Institute of Information Technology (NIIT) is of course one of India and Asia’s finest skills and talent development organizations. The IFRS certification course offered by NIIT Imperia aims at enabling early acceptance of the list of IFRS standards and effective implementation. The NIIT Imperia course is targeted towards senior financial professionals. The program focuses on IFRS Implementation Issues, accounting for measurements, products, disclosure and recognition. Candidates, by the end of this certification course are able to implement all finance functions as per the IFRS requirements. Since the course is targeted towards experienced professionals it puts specific emphasis on providing the information needed to restate Indian financial statements as per IFRS requirements, the various nuances around recognizing and measurement of elements as per IFRS, and the primary differences between Indian GAAP and international IFRS.

IFRS is an area closely regulated by international bodies such as the US SEC and UK’s Financial Reporting Review Panel, the NIIT program provides extensive information to handle the complexities of IFRS.

Course Highlights

- Deliver high standards of learning and development.

- Online and Classroom trainings

- High-quality trainers

- Develop ones’ knowledge on the list of IFRS standards

7. IFRS by Meraskill

IFRS Certification Course by Meraskill deals with imparting extensive practical training using the case study approach in the domain of finance. . Their focus in aligning corporate knowledge and proficiency in academics to equip aspirants with the required professional skills to help them get better career breaks. Students taking up this IFRS Certification course become well-versed professionals in the financial domain which helps them to meet industry standards along with knowledge.

Course Highlights

- Online pre-recorded classes

- Queries handling via WhatsApp and Webinar

- Access for two examination terms

- Practice and revision materials

- Develop ones’ knowledge on the list of IFRS standards

- Individualistic pace learning

8. Tishadz

Tishadz IFRS Certification Course is for aspirants wanting to pursue their profession in financial domain and services. Every company has its core competency secured by the finance team. Therefore it is easy to consider the finance team as the goalkeeper of the company. This IFRS certification course ensures the candidates understand how to use these standards for the smooth functioning of all financial processes. They also learn how to use these standards practically in the day-to-day operations to maximize profit and minimize cost.

Course Highlights

- Individualistic pace learning

- Unlimited access to study materials and learning videos

- Mock-ups and Assessments

- Develop ones’ knowledge on the list of IFRS standards

- Dedicated IFRS experts available to clear doubts

- Constant Monitoring and Feedback

9. Techou Technical Training & Research House

Techou is a premier training establishment that imparts financial education for a variety of needs from beginner to advance. Techou provides training from beginner courses on how to invest in the stock market to intermediate courses for students seeking to jump-start careers in finance to advanced courses for investment professionals. Techou has IFRS certification course both in their institute in Indore as well as online.

The Techou course prepares you for the Diploma in International Financial Reporting. The course first covers the essentials of financial statements like revenue, Property, Plant and Equipment (PPE), leases, borrowing costs, government grants, income tax and so on, the treatment of each element and then moves to more advanced topics like consolidation of financial statements, proper reporting of various financial events such as acquisition, investment, borrowing, taxation etc.

Course Highlights

- High quality of professional teachers

- Impart practical knowledge

- Develop ones’ knowledge on the list of IFRS standards

- Live trading sessions

- Supportive staff for assisting with the needs of the students

10. FinOptions Institute of Financial Studies

FinOptions is a top-notch financial training house with a specialization in building professional and financial domain skills in students to enable access to better opportunities for their careers. Along with IFRS certification course, FinOptions offers training targeted towards finance students for certification in CFA International, NISM Certification for Securities Markets, NCFM for Financial Markets etc. For non-Finance students there are courses in Project Financing.

FinOptions approach is unique in that all the instructors are industry professionals who additionally are certified trainers. Instructors being industry professionals enables the students to learn both the theory as well as build a practical understanding of how the theory is applied in real-life situations. The trainers have extensive teaching experience having imparted training to over 1500 financial professionals.

FinOptions Institute of Financial Studies has a rich track record of placing students into top-tier companies for research and knowledge process outsourcing. It is a preferred training partner for many leading financial institutions such as SBI, LIC and private banks.

Course Highlights

- High quality certified trainer

- Impart practical knowledge

- Develop ones’ knowledge on the list of IFRS standards

- Provide a forum and opportunity for students to build their own professional networks

-

Why is IFRS Certification Course in Demand?

- The merging of Indian Accounting Standards (IndAS) with IFRS makes being IFRS certified more important.

- 130+ counties have already adopted the list of IFRS Standards. Seeking jobs in these countries make IFRS Certification a mandate.

- Countries like Hong Kong, Australia, and South Africa have already accepted IFRS as their Generally Accepted Accounting Principles (GAAP).

- EU complies with IFRS

- Many other countries have started applying for IFRS as a single set standard recognized worldwide helps.

- The IFRS diploma by ACCA is widely accepted around the world.

- Capable IFRS professionals can become entrepreneurs by starting their consultancy firms.

- It is easier to find job opportunities with the knowledge and understanding of these dynamic standards in the banking sectors, with insurance companies and with all other companies adopting the Dip-IFR standards.

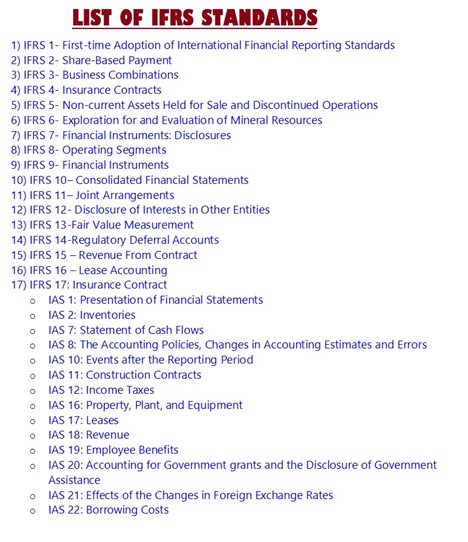

What Is The List of IFRS Standards?

International Financial Reporting Standards is also termed as IASB Standards. Any International Accounting Standards (IASs) and Interpretations are given out by the former body IASC or SIC is applicable unless they have been amended or else withdrawn. Find below the list of IFRS Standards

-

To Whom Will This Course Benefit?

IFRS certification course is a value-adding degree to add to one’s resume in case one is an accounting professional. Anyone with the below degrees can take up this course

- Chartered Accountants

- Analysts and Consultants

- Company secretaries

- Chief Accountants

- Private Equity and M&A professionals

- Management Accountants

- Cost Accountants

- Semi qualified CS, CA, ICWA

- Financial Managers

- MBAs with Finance as major

- Professionals working in the accounting domain

- Graduates or Post-graduates working with accounting or finance teams

Various IFRS Certification Course

There are different Institutes offering IFRS Courses. Below are few recommended courses

- ACCA’s Diploma in International Financial Reporting is for 3-6 months. This IFRS certification course is for graduates with 3years+ experience in finance, commerce post-graduates with 2years+ experience in finance, practising accountants and auditors.

- KPMG offers an Advanced Certification Program on IFRS for 6 weeks. This certification is open to working professionals with 2+ years of experience. However, in case one has done their MBA (Finance), CWA, CA or CS, this experience is not required.

- ICAI for the CA members offers Certificate Course on IFRS. This can be completed by investing 100 hours.

- ICWAI’s IFRS Certificate Course is for 2 months. Students, university faculties, chartered accountants, cost accountants, middle / senior-level executives and company secretaries in multinationals or statutory bodies can benefit from this.

- Another 40 hours IFRS / IND AS Certification Programs is also available. This is for professionals and students attempting the ACCA exam.

Eligibility Criteria for IFRS

- One must qualify as a Chartered Accountant or have two to three years of relevant accounting experience.

- One must be an auditor or a professional accountant who has worked in some business or practice. One must be qualified according to the national accounting standards, to be eligible to attempt this certification.

- If one is not qualified but employed and in practice they might still be edible if they meet the below criteria:

- 2 years of significant accounting practice and a recognized degree ( that attracts ACCA prerequisite exemptions for Applied Knowledge and LW exams)

- 2 years of significant experience in accounting experience and an ACCA Certification in International Financial Reporting

- 3 years of relevant accounting practice

- ACCA affiliation status

Key Features of IFRS Certification Course

- Equips candidates to be able to understand the framework and the structure of international accounting

- This certification ensures that the candidate is able to apply their knowledge on financial reporting standards to main elements of the reports

- IFRS certification course help candidates to Identify and apply disclosure requirements for companies in financial reports and notes

- Prepare group financial statements (does not include group cash-flow statements) including subsidiaries, associates and joint ventures.

Training Institutes for clearing IFRS certification course or self-study?

From an academic point of view, one can take up the IFRS certification course and clear the exam by self-studying. However, this might be different for different individuals based on grasping capacity and speed. One has to focus on attempting prior question papers. 3-4 weeks of preparation is enough. That should include at least one revision. The study material for IFRS Certification course is easily available online for self-reference like Becker Professional’s study material and many more. Consolidated Financial Statement problem solving and the complete IFRS standard theory are important aspects one needs to focus on.

However, a pre-planned and channelled method of studying always increases the possibility of clearing this certification course in the first attempt itself. Enrolling oneself with one of the above Institutes for the IFRS certification course will help you understand and learn about the Standards in depth. In terms of answering queries or problem solving, most institutes provide expert guidance and support. One also gets access to ready-made study materials, old question banks etc. from them which otherwise one has to search online. This saves preparation time have less time. Most training institutes also conduct mock-tests for their candidates giving them an idea of the exam pattern and where they stand. This can be a great help before taking the final certification test.

Career Openings after IFRS Certification Course

- In Insurance Companies

- In Banks

- In Audit Firms

- In Professional Advisory Establishments

- All other organizations following IFRS standards

After doing an IFRS certification course one can expect to seek global opportunities in the Middle East, EU etc. easily as this course helps one gain a good knowledge of IFRS and also the list of IFRS standards that is followed by the counties there.

IFRS Certification Course – Scope for Professionals

Organizations, both profit-oriented and Non-profit find the list of IFRS standards appropriate. This list of IFRS standards applies to all general purpose financial statements and all financial reporting done by profit-oriented entities involved in industrial, commercial, financial, and related activities.

As IFRS certification course is a worldwide recognized course it has more demand and is of uttermost importance to companies that have a good name in the industry. These companies prefer hiring candidates who have knowledge and expertise in IFRS international standards along with their regular specialization in finance or accounting. Many businesses have made this requirement compulsory as their business standards need the expertise according to the eligibility criteria.

Today many IFRS profiles are being offered in every sector of different industries that include software, ITES, pharmaceutical, professional advisory companies, auto spare part, Insurance industry, auditing firms, banks and KPOs.

IFRS Course Institute in Indore with Syllabus

The IFRS course content is comprehensive and the syllabus includes understanding important components of budget summaries, and how to use applicable worldwide monetary disclosure norms.

Recognize and implement disclosure requirements for materials related to the introduction of budget summaries and notes. Plan bunch budget reports, including auxiliaries, partners, and collaborative courses of action (barring bunch income articulations), etc.

IFRS Course Institute in Indore Fees

The course fee for live sessions is Rs. 17500/- and this includes live recorded sessions, benefits of the self-paced course, and also one-year gold membership worth Rs. 6000/- for free the benefits include live recorded sessions of all the batches, weekly Bootcamp sessions, career-building sessions, two extra modules such as soft skill training and resume building, etc.

Recommended Reads:

- Top 9 IFRS Institutes in Bengaluru

- Top 9 IFRS Certification Course in Mysore

- Top 10 IFRS Courses In Ahmedabad with Scope, Eligibility & Duration

- List of International Financial Reporting Standards

- Top 10 IFRS Certification Courses in Bangalore with Scope & Jobs

FAQ:

Q1. What are the Eligibility Criteria of IFRS Certification?

Ans. One must qualify as a Chartered Accountant or have two to three years of relevant accounting experience.

One must be an auditor or a professional accountant who has worked in some business or practice. One must be qualified according to the national accounting standards, to be eligible to attempt this certification.

If one is not qualified but employed and in practice, they might still be edible if they meet the below criteria: 2 years of significant accounting practice and a recognized degree ( that attracts ACCA prerequisite exemptions for Applied Knowledge and LW exams)

2 years of significant experience in accounting experience and an ACCA Certification in International Financial Reporting

3 years of relevant accounting practice

ACCA affiliation status

Q2. What are the career openings after the IFRS Certification course?

Ans. In Insurance Companies

In Banks

In Audit Firms

In Professional Advisory Establishments

All other organizations following IFRS standards