Table of Contents

HR and Payroll are mostly common words nowadays. For any business no matter small, Medium, Large. Happy Employees are key to business growth and development. Payday is an important day for all your employee. It is essential that employees are paid accurately and on time. With accurate payment, it is necessary to right deduction, Right Allowance, and contribution to the superannuation Fund. This is vital not just for your employees but also for your taxes and overall you’re financial Health.

Payroll is not a simple process. You need to understand:

What is payroll?

A payroll is a company’s list of its employee but the term is commonly used for the total amount of money that a company pays to employees.

To master your payroll and keep your employees happy, you need to understand how it all works.

Kanpur city

Kanpur is known as cawnpore. Founded in 1803. It is the largest city in Uttar Pradesh in India. Kanpur is the biggest city in the state and is the main center of commercial and industrial activities. It lies on the banks of Ganga. Now it is the commercial capital of Uttar-Pradesh. Uttar-Pradesh has become one of the education hubs of India. Uttar-Pradesh has 63 universities and 1000 colleges.

Top 10 HR Payroll Courses in Kanpur

1. Henry Harvin

Henry Harvin Education is one of the well-known institutes in professional and technical certifications in India. Henry Harvin knows the existing curriculum of academics. And what are the requirements of nowadays industry? With this understanding, Henry Harvin has focused on offering HR payroll courses in Kanpur that can add value to the portfolios of both working professionals and students as well as enhance the knowledge base of organizations? HR payroll course in Henry Harvin also helps both aspiring and seasoned professionals to explore to grab the job market. Mainly focus on content understanding and project work-based learning.

About the Course:

Effective management of human resources is important for the success of all organizations. The HR function is key to an organization as it enables the achievement of strategic goals. Certified HR Payroll Specialist (CHRPS) Course provides an understanding of basic Human Resource Management and prepares the candidates for HR professional roles in the global environment.

Duration:

- certification program with 32 hours of online training.

- Next 12 months 24 hours of boot camps.

Trainer:

- 10+ years of experience as a teacher in this respected industry. and recognized by numerous organizations over the years for their work

- Our trainers are Experts with Henry Harvin HR Academy

- Continually upgrade themselves with new tools to impart the best training of a real workplace environment

- Always ready to help and assist students in their training tenure.

Gold Membership Benefits of HR Academy:

- E-Learning Access: Access to recorded videos, games, projects, case studies, etc.

- Monthly Bootcamp Sessions: Brush up your concepts with our regular Bootcamp sessions held every month.

- Job Opportunities and Internship: HR Payroll Course graduates get 100% placement assistance and internship opportunities with Henry Harvin.

- Interview Guaranteed: facing and clearing the interview support

- Complimentary Modules: Gain access to Complimentary Modules, Soft Skill Development, and Resume Writing along with the course curriculum of HR Payroll Training Course

Benefits of HR payroll course:

- Learn your HR skills, take your knowledge to the next level, and rocket-launch your dream HR career.

- Work independently for any HR function in real-life situations.

- Gain sound knowledge and technical skills in Payroll auditing, Payroll accountancy, Salary marking, Provident fund, and ESI schemes, Tax deduction, and Saving Schemes, Corporate and Labor Laws, Financial Management, Direct and Indirect Taxation, IT, and related subjects.

- Train in theoretical & practical training and computer training deemed necessary under this HR Payroll training course.

- Improve the efficiency of your organization by processing the payroll of the employees in a more timely and accurate manner.

- Learn about several Indian Provision Acts and laws of business while performing your job.

- Career Benefits:

- Work as an HR payroll specialist in top-level companies. Become an Important and highly significant person for the company you work for.

- HR payroll course in Kanpur will give you better job opportunities and security, so no need to worry about finding a suitable job for you.

Eligibility:

- Finance, HR, and Payroll Executives

- Job seekers looking to find employment in Payroll and Human resource department

- Employees who are working in the Payroll Department

- Existing employees looking for a better role to prove to their employers the value of their skills through this certification

- Graduates looking for a Successful Career

- Employees switching to HR Profession from any domain

Curriculum:

- Overview of Payroll Management

- Labour Law Statutory Compliances & Computation

- Tax Saving Investment Deductions and Exemptions

- Payroll Processing and Reports

- Soft Skills Development

- Resume Writing

Cities in India where Henry Harvin HR PayRoll Course is provided:

Other Henry Harvin Courses:

- Accounting and Taxation course

- GST course

- Business Analytics Course

- SAP FICO Course

- Business intelligence course

2. Udemy

- You will be able to describe the key factors in the development of HR and People Management

- You will be able to outline the role of HR

- Understand Business Strategy and how it is important to HR

- HR Analytics and its importance

- concepts of Unitarian & Pluralism

- You shall be in a position to discuss what is meant by Performance Management in an HR Context

- You will have knowledge of conducting appraisals

The course is for:

- Who wants to learn People Management/ HRM

- Those wanting to accelerate their HR career

- HR Professionals

- People wanting to understand HR and its relationship with line-management

- who wants to understand why HR is important

- Anyone looking at HR Career

Rank# 3. KPMG

As a firm, we look at the future full of excitement, and confidence. Here, at KPMG in India, we believe in extraordinary power. Who love themselves and want to transform their life. We are here to help and that is what best defines us!

Objectives of the HR payroll course:

- Deep knowledge of payroll and income tax calculations as per the income tax rules and regulations

- Deep understanding for payroll professionals on various income tax components and retiral payments

- To keep HR payroll professionals up to date with latest income tax trends/impacts of changes in tax and social security laws of India

- Deep understanding to HR payroll professionals to identify the common gaps in the HR payroll process and payroll accounting

- To upskill HR payroll professionals who are dealing with basic assessment-related issues.

Key Points:

- 8 hours live session and live webinars conducted by KPMG in India.

- It is taught through practical examples and case studies.

- Participants can reach out for doubts during or after the sessions. Participants will also get access to LMS for 1 year which will have readable documents.

- This payroll course is suitable for both; professionals who are currently not working as HR payroll employees and HR payroll professionals who wish to advance their careers.

Curriculum :

- Payroll process

- Pay components – taxability and specific checkpoints

- Eligible deductions

- TDS Mechanism – Snapshot

- Employees’ Provident Funds & Miscellaneous Provisions Act, 1952

- Employees’ State Insurance

- Payment of Gratuity Act, 1972

- National Pension System

- New Labor Codes

Course Fees:

- 1st year- INR16,000 plus taxes.

- 2nd year- INR12,000 plus taxes.

- Check- HR Payroll Course in Delhi

4. Crasskill:

Curriculum:

All curriculum is being updated regularly towards the current job market standards.

100% hands-on training methodology is being followed in our institute.

Trainers:

Our trainers are industry experts who are real-time working HR professionals.

Other facilities:

Placement assistance may be provided to the students as per our institute policy.

Lifetime support in learning shall be accessed through our student forum.

Duration:

20 Hours instructed led online

Eligibility:

- Minimum Graduation

- Anyone who wants to learn HR payroll

Fees:

- 12,500 INR (Included Exam, handouts, certificate)

5. LIBA (Loyola institute in business administration)

Key Points:

- Designed for Working Professionals

- 300+ Hours of Learning

- 8+ Case Studies and Assignments

- 30+ Hours of Live Sessions

- 360 Degree Career Assistance

- Program Completion Certificate from LIBA & Alumni Status

- Weekly Doubt Clearing Sessions

- Practical

- Support available all days 9 AM – 9 PM IST for queries

Eligibility:

- Any candidate with graduation from a recognized University.

- Or a professional qualification recognized as equivalent to a bachelor’s degree.

6. NAS solutions in Kanpur:

Our main motive is to work with the best training providers that help training seekers or students to achieve their aims.NAS Solutions helps training seekers and training providers to get one optimal platform, where they can find their best trainings information within no time. It is an intuitive yet easy-to-use online portal for training providers to find the best training seekers. Established in the year 2012 by an enthusiastic team, it is a growing network of more than thousands of training providers from different countries across India.

About Course:

NAS Solutions Pvt. Ltd., a reputed company renowned for HR payroll course in Pan India, now offering

First Time in LUCKNOW

FREE DEMO CLASSES EVERY Saturday at 11:30 a.m.

Daily one hour session

Curriculum:

- Statutory & Legal Compliances (PF, ESIC, etc)

- Compensation & Benefits

- Tax Planning for Salaried Employee

- Recruitment & Selection

- Brief Knowledge about HR Generalist /HR Executive

7. HR Training solutions HR payroll course in Kanpur

Core HR training provides complete HR solutions in the Hr field. We provide HR Payroll course in Kanpur and HR practical training according to company need and ISO CERTIFICATE in Human Resource Practical Training.

Other Course:

- HR Payroll

- HR Recruitment

- HR Short Course

- HR Diploma Course

Also check- HR Payroll Course in Mumbai

8. Samuel Overseas Training Institute, Kidwai Nagar Kanpur

They are a reputed foreign language institute in TOEFL, German and French, IELTS And TOEFL, English Speaking Course and Personality development

Location:

Kidwai Nagar – Kanpur

Postal Code: 208011

Other Course:

- Core HR

- HR Payroll

- HR Placement

- HR Short Course

9. ERUDITUS:

Eruditus offer HR payroll course in the classroom and online.

Our mission is to bring high-quality education to people across the world. We create world-class online courses in partnership with some of the most reputed universities in the world – Harvard, Wharton, Columbia, IIT, IIM – and enable students from across the world to access these courses. What is exciting about the Eruditus group is how global we are: we have students from across the world and offices in all the world’s major regions.

10. Inventateq:

Learn HR payroll course both classroom training and Instructor-led, Analytics and much more subject to Human Resource. All businesses rely on HR professionals for hiring new people, training, and discipline. So HR professionals are in demand nowadays.

Benefits:

- 100% Guaranteed Placement Assistance in IT Companies.

- Training in Payroll, Generalist hr, Recruitment, Employee Assessment, HR Analytics

- HR Instructor has 11+ Years Experience

- Real-time Project Training

- Certification in HR

- CV Preparation and Interviews

What is the payroll department?

A specific unit of an organization under which the payroll system works. The primary mission of the payroll department is to correct withholding, deduction, and remittances promptly. This includes salary payments, tax withholdings, and deduction of paychecks.

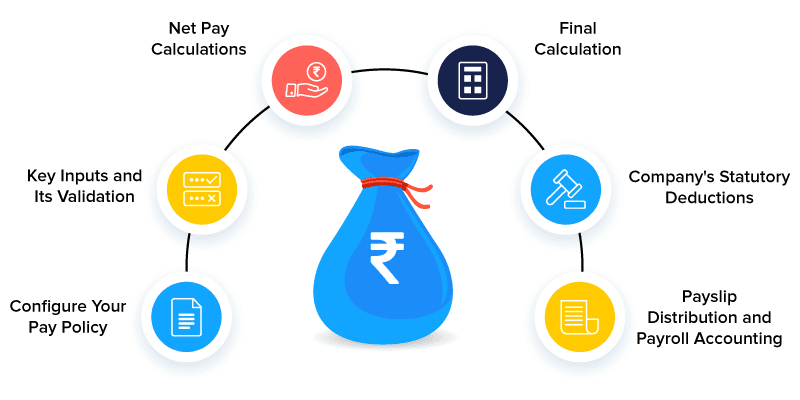

What is a payroll system?

A system where the details of records related to the payroll are managed, maintained, and calculate. Without the right knowledge, this payroll system can fill complex, Difficult, and screamingly impossible.

Payroll is not a simple process. For this you need to understand the following Key points:

- Payslip

- Allowance

- Deduction

What is a payslip?

When you get the wages after one month of hard work, it is called a salary slip or payslip. Your Gross salary should go through several factors. These factors calculate in the final payroll for Employees’ wages. The money you received is not just your hourly or salaried amount.

It includes Various Allowances, Deduction, and superannuation funds.

What is an allowance?

The allowance is any additional amount given to the employee from their employer for work of small expenses. Like- Petrol Money, uniform washing, Travelling Expenses.

Sometimes allowances are tricky-

Some are paid to third parties, such as school fees or rent If your allowances are paid to a third party, they will be directly sent to the third party bank account.

Some allow affect taxes and some don’t. Allowance before tax is included in the employee’s taxable pay. These allowances usually represent additional pay as compensation for working conditions or special skills.

Taxable Allowances are usually mentioned in the gross salary column (Tax Certificate/ Pay deduction Certificate)

Allowances that are not taxed are called “After Tax”. Allowances after-tax are included in the employee’s Gross payslip, not in their taxable pay.

These all allowances are usually represented expenses that could be claimed by employees as tax deductions. Non-taxable allowances are usually shown separately in the allowance column on the (tax certificate/ payee deduction certificate).

“After-tax allowance” like- car allowance

Overtime meal allowance

A leaving away from home allowance

What is Deduction?

A deduction is any amount of money taken from your wage for various reasons. Like- loan from your company.

When you are paying a loan back, a loan deduction is every month. Some deductions affect taxes and some not the same as allowance.

Example-

- Deduction: A deduction that would not have a tax is repayment of company expenses. As in this deduction has nothing to do with wages.

- Breakage: If employees damage any equipment like computers, furniture, etc, there may be subject to deduction.

Few deductions are “Before-tax”. The same goes for allowances. Select the “After-tax” if the deduction is not to affect the calculation of tax.

Deduction after-tax does not affect the employee’s Gross or taxable Pay but is simply subtract from the employees’ net pay. This would be the normal selection for most deductions. A salary sacrifice though would normally be taxed.

So, when you are looking at the wage. Here is what you can see-

Wage or Amount earned for work (salary pic)

All the allowances (taxable and non-taxable)

All the deduction (taxable or non-taxable)

Now your payroll makes a lot more sense.

Now you understand how payroll works. You need to fully understand the following things:

- Superannuation Contribution

- Leave money

- Work cover

In addition to allowances and deduction. We need to also give a contribution to our superannuation fund.

Superannuation is also known as a retirement fund. Every employee knows how important this superannuation fund is. Employee and employer both pay this fund as both know the value.

An employer also needs to pay for sick leave, study leaves, Holiday pay, leave pay.

Work cover means if any accident happens in the company.

Now we have to understand the elements of our paycheck:

- Net wages will go to your bank account or cash.

- The deduction will go against whatever they were for like- a company loan, cleaning your uniform.

- Taxes withheld to send to the tax office

- Payslip will give to you or Email to you.

- Records will flow through to the company general ledger.

- So that everything will track correctly.

- Now you came to know your payroll is not a simple process, Is It?

- It is essential for your business your payroll runs accurately and officially. Once you know what you are doing? Then everything was the To accounted for correctly. Your employee gets proud of with wages. So your business runs smoothly and happily.

- As a payroll officer, you’re the foremost influential person within the company. Once you do your job correctly. You are the truth and most vital person of the corporate.

Other Payroll components:

Payroll software:

Payroll software is urged to manage. And streamline the method of creating payments to employees. Company’s payroll software to automate such things as calculating payments tax and incometax and depositing monthly payments into the designated bank of employer manage to attendance, leaves, PF, ESI, automatically compared to paper-based system payroll software significantly speeds the payroll process. While errors and enabling managers to more easily customize paychecks for the individual employees.

Statutory compliance:

- The word statutory means of or associated with the status, rules, and regulation. Compliance means adherence. Thus statutory compliance means adhering to rules and regulations.

- Statutory compliance in HR refers to the legal framework that a corporation should adhere to in handling its employee.

- Advantages for employee-

- Ensure fair treatment of Employees.

- Ensure they are paid fairly for the work they need to be done and their company complies with the minimum earnings rate.

- Prevents employees from working for long hours.

- Advantages to an organization-

- Avoid penalties as a result of their timely payments.

- Protect the organization from unreasonable wage or benefit demands from the trade unions.

- Prevent legal troubles because the company is fully compliant.

- With compliance in situ, there’s an occasional risk of an adverse incident.

HR payroll course is highly recommended to Individuals and Company owners who run the company. HR payroll course is introduced to the basic concepts surrounding payroll and gives you a brief step-by-step guide to how it all works. It clarifies different payroll components like Gross wages, Deduction, tax withholding, TDS, Net salary.

HR payroll course is beneficial for all individuals who want growth in their professional life. Is an important element to Employees and Employers. The employer wants to run his business smoothly. If the employee of the company is happy so company growth is definite in all aspects. Because of pandemics nowadays all courses are available in both classroom training and online. There was something good behind every bad thing. Also, those who used to be busy with work or household responsibilities can now do this course according to their schedule.

Recommended Reads:

- HR Payroll Courses in Coimbatore

- HR Payroll courses in Pune

- Accounting and Taxation Course Online

- GST Course in Delhi

Ans- Any candidate with graduation from a recognized University.u00a0

Or a professional qualification recognized as equivalent to a bacheloru2019s degree.u00a0

Ans- Yes, every institute has their own process. So you have to check with HR people and you will get your certification.

Ans- It depends which institute you choose. You connect with HR people of the institute. They will help you out in this manner.u00a0

Ans- The payroll course only helps to understand the payroll processes, payroll compliance and taxation laws related to payroll. It shares tax knowledge, but it doesnu2019t certify you to do processes of the income tax return.u00a0