Table of Contents

Understanding the Significance of Financial Accounting

Financial Accounting is an evergreen field that can be a great career option for you.

Financial accounting is a branch of accounting that focuses on the preparation and reporting of financial information to external stakeholders, such as investors, creditors, regulators, and the general public. Its primary objective is to provide accurate, reliable, and relevant financial information about a business entity’s performance, financial position, and cash flows.

If you are looking for a career in the field of Financial Accounting and Taxation Course you will need to upgrade and gain in-depth knowledge of accounting in various aspects of business, finance, and even personal finance as follows:

- Financial Reporting: Accounting provides a structured way to record, summarize, and report financial transactions of a business.

- Decision Making: Accurate financial information generated through accounting helps stakeholders make informed decisions.

- Performance Evaluation: Accounting enables the evaluation of business performance over time.

- Taxation: Accounting plays a crucial role in tax compliance and planning.

- Investor Relations: Investors rely on accounting information to assess the potential returns and risks associated with investing in a company.

- Risk Management: Accounting helps identify and mitigate financial risks by providing insights into areas such as liquidity, debt levels, and asset management.

- Resource Allocation: Effective accounting practices assist in optimizing resource allocation by providing insights into the profitability and cost-effectiveness of different business activities.

Objectives of Financial Accounting

Upcoming Batches of Accounting and Taxation Course :-

| Batch | Mode | Price | To Enrol |

|---|---|---|---|

| Starts Every Week | Live Virtual Classroom | 34500 | ENROLL NOW |

Financial Accounting refers to book-keeping transactions by classifying analyzing, summarizing, and recording financial transactions like sales, purchases, receivables, and payables. By preparing the financial statements which include income statements, Balance Sheets, and Cash Flows.

It’s to showcase an accurate and fair picture of the financial affairs of the company. We need to understand the fundamentals of financial accounting so that we can start with a double-entry system, debit &credit, and then gradually should understand journal and ledger, trial balance, and four financial statements.

Financial Accounting Principles

As financial accounting is solely prepared for the right disclosure of financial information of a company the statements and reports the company produce should be valid and reliable of a company. That’s why companies need to follow certain rules as per the Generally Accepted Accounting Principles (GAAP) or accounting standards.

GAAP covers the basic principles which should be followed by companies. These principle includes going concern concept, full disclosure concept, matching principle, cost principle, and many others to produce the most accurate and reliable reports for the audience of the company.

However, GAAP doesn’t remain the same always since it keeps updating its database that arises in the world of Accounting as and when. After understanding the join responsibility we have filtered pout interview questions which can be a cakewalk for any with this Guide.

Need of Accounting Interview

Demonstrating your job-related skills and industry knowledge is key in making a strong impression in an Accountant Interview. Prospective employers want to understand how you work and how you might fit in at their company. Apply on this job order to understand the employer’s perfect applicant before your conversation. Accomplishing such can assist you to approach any needed abilities, features, and participation in your answers. To prove that you are the right candidate for the position, provide examples that capture your professional achievements and skills in addition to your personality in accountant interview questions.

Basic Accountant Interview Questions

1. What are the Three Important Financial Statements?

The balance sheet shows the company’s assets, liabilities, and shareholder’s equity. The income statement outlines the company’s revenues and expenses. The cash flow statements show the cash flow from operating investing and financial activities.

2. Name the one Statement to Review the Overall Health of a Company, Which Statement Would I use, and why?

Cash is King. It’s a cash flow statement that gives a picture of how much cash the company is generating. It’s important to know all the 3 statements truly required to get a full picture of the health of a company. The three financial statements are linked.

3. What Happens to the Inventory if the Income Statement goes up by $10?

It’s a very tricky question the only impact will be on the balancer sheet and cash flow statement.

4. Define Working Capital?

Working capital is defined as present assets with fewer liabilities, in banking working capital is normally defined hardly as current assets (excluding cash) less current liabilities (excluding interest-bearing debt).

5. What is Negative Working Capital Mean?

Negative capital is very common in some industries such as Hotels and Grocery retail businesses. In grocery shops customers pay upfront, inventory moves relatively quickly but suppliers give 30 days (o more) credit. This means that the company receives cash from customers before it needs cash to pay suppliers. Negative working capital Is efficiency in business with low inventory and accounts receivable? In other trades, undesirable working capital is an indicator a company is facing financial trouble.

6. Cash Collected from the Customer is not Recorded as Revenue what Happens to it?

It generally goes into a Differed Revenue on the balance sheet as a liability if the revenue has not been earned yet.

7. Difference Between Deferred Revenue and Accounts Receivable?

Deferred revenue shows the cash received from the customer for services or goods not yet provided. Accounts receivable signify cash due from consumers for goods/services already provided.

8. How does capitalize rather than expense a purchase?

When the purchase is used in the business for more than one year it is capitalized and depreciated.

9. What Circumstance Good Will Increase?

When a company buys another business for more than the fair value of its tangible and intangible assets, goodwill is created.

10. How do we Record PPE and its Importance?

The main four areas to consider when accounting for PPE on the balance sheet, intimal purchase, depreciation, additions (capital expenditure), and dispositions. In addition to these four, you may also have considered revaluation. For many businesses, PPE is the main capital asset that generates revenue, profitability, and cash flow.

11. How does Inventory Write-Down Affect the three Statements

In the balance sheet, the assets account of inventory is reduced by the amount of the write-down so is the shareholder’s equity. The income statements are hit with an expense that is either COGS or a separate line item for the amount of the write-down. On income statements, the write-down is added back to CFO as its non-cash expense but must not be double-counted within the changes of non-cash capital.

12. What are three Samples of Common Budgeting Methods in the Accountant Interview Question?

Examples of common budgeting methods include zero-based budgeting, incremental budgeting, and value-based budgeting. Learn more about the various types, in CFI’s budgeting and forecasting course.

13. Explain the Revenue Recognition and Matching Values?

The revenue recognition principle dictates the method and timing by which revenue is recorded and recognized as an item within the financial statements supported certain criteria (e.g., transfer of ownership). The matching principle dictates that the timing of expenses be matched to the period in which they are incurred, as opposed to when they are paid.

14. If you were CFO of our Business, What Would Keep you up at Hours of Darkness?

Step back and give a complex impression of the business’s current economic position, or companies in that industry overall. Highlight something on each of the three statements. Income statement: growth, margins, profitability.

Balance sheet: liquidity, property assets, credit metrics, liquidity fractions.

Cash flow statement: short-term and long-term income outline, needing to improve money or return capital to stakeholders.

Common Accounting Interview Question and Answers

- Can you explain the basic accounting equation?

The basic accounting equation is Assets = Liabilities + Equity. It represents the fundamental principle of double-entry accounting, where every transaction affects two or more accounts, ensuring that the equation remains balanced.

- How do you ensure accuracy in financial statements?

To ensure accuracy in financial statements, I meticulously review transactions, reconcile accounts regularly, and perform detailed variance analysis. I also adhere to accounting principles and regulations, seeking clarification when needed.

- What experience do you have with financial audits?

I have experience preparing for and participating in financial accounting audits, both internal and external. This involves organizing documentation, facilitating auditor requests, and addressing any findings or discrepancies identified during the audit process.

- How do you handle discrepancies in financial records?

When discrepancies arise, I first investigate the root cause by reviewing transactions and reconciling accounts. I communicate findings with relevant stakeholders and collaborate to implement corrective actions. Documenting the resolution process ensures transparency and prevents recurrence.

- Can you explain the difference between GAAP and IFRS?

GAAP (Generally Accepted Accounting Principles) is a set of accounting standards used primarily in the United States, while IFRS (International Financial Reporting Standards) is a globally recognized set of accounting standards. While both aim to ensure transparency and comparability in financial reporting, they may differ in certain principles and requirements.

- How do you stay updated with accounting standards and regulations?

I stay updated with accounting standards and regulations by regularly attending professional development seminars, participating in online courses, and following reputable accounting publications and regulatory updates from organizations such as the FASB and SEC.

- How do you prioritize tasks and manage deadlines in a fast-paced environment?

I prioritize tasks by assessing their urgency and importance, utilizing tools such as to-do lists and project management software. I also regularly communicate with stakeholders to manage expectations and adjust timelines as needed. Adapting to changing priorities and staying organized is key to meeting deadlines effectively.

Fresher Accountant Interview Question

Here is the accountant Interview Question for fresher also as experienced candidates to urge their dream job.

1. Why Prefer to Account as a Profession?

Accounting is chosen as a profession because:

- Become a neighborhood of an in-depth network of execs.

- Accept or experience a challenging role.

- Explore new opportunities.

- Offers all types of career options.

2. What are the Talents Needed to Figure as an Accountant?

Skills needed to figure as an accountant are:

- Excellent at math

- Strong analytical skills

- Structured work style

- Aptitude for technology

3. Mention some Accounting Software?

The best accounting software is:

- Fresh Books

- NetSuite ERP

- Tipalti

- Free Agent

- Zoho Books

- Sage Business Cloud Accounting

- Sage 50cloud

- Tally

4. Mention the Difference Between SAP Memory and ABAP Memory

SAP Memory may be a global user-related memory that extends beyond the limit of transaction.

ABAP Memory may be a memory area within each main session and may be accessed by programs using the import-export statement.

5. What’s Microsoft Accounting Professional?

Microsoft Accounting Professional is an accounting application that gives reliable and fast processing of accounting transactions. It also helps with financial analysis.

6. What’s the Acronym for the Accounting Words Debit and Credit?

The debit version is “dr” and the credit summary is “cr”.

7. What Percentage of Sorts of Business Transactions are There in Accounting?

There are two sorts of transactions in accounting, i.e., revenue and capital.

8. What’s the Balance Sheet?

It’s a press release that states all the liabilities and assets of the corporate at a particular point.

9. What’s TDS?

TDS stands for a tax write-off at Source. it’s introduced to gather text from the corporate form where the worker income is generated.

10. Where to Point out TDS With in the Balance Sheet?

TDS is shown on the assets section, right after the top current asset.

Beginner Level Accountant Interview Questions

1. Types of a Business Transaction are There in Accounting?

They are two types of business transactions in the accounting field that revenue and capital.

2. Name Real and Nominal Accounts with Examples.

A real account is an account that has assets and liabilities Eg: land account and building account.

A nominal account is an account of income and expenses Eg: wagers account and salary account.

3. Which Accounting Platform have you Worked for and Which one do you Prefer?

The accounting platforms are (Quick Books, Microsoft Dynamic GP, etc.) that you have worked with and which one you like the most.

4. What is Double-Entry Bookkeeping? What are the Rules Associated with it?

Double entry is an accounting standard where every debit features a corresponding credit. The total debt is always equal to the credit. In this system when one account is debited then another account gets credited at an equivalent time.

5. What is Working Capital?

Working capital is calculated as current assets minus current liabilities that are used in day-to-day trading.

6. In What Way do you Maintain acCounting Accuracy?

As an organization, it is very important to maintain the accuracy of accounting or which will end in huge loss, there are various tools and resource which may be wont to limit the potential for errors to sneak in and address quickly if any errors do arise.

7. Explain TDS? Where is TDS Shown in the Balance Sheet?

TDS (Tax Deducted at Source) is a concept aimed at collecting tax in every source of income. In a balance sheet, it is shown on the assets section right after the head current assets.

8. Difference Between Account Payable and Account Receivable? This is a very Commonly used Question acCountant Interview Question?

Accounts payable is defined as the company owes it purchased goods or services on credit from a vendor or supplier.

Eg: Account payable are Liabilities

Accounts Receivable is defined to collect company right that is sold goods and services on credit to a customer

Eg: Accounts receivable are assets.

9. Difference Between Trial Balance and a Balance Sheet?

Trail balance is a sheet with all the list of balances in a ledger account and is used to check the mathematical accuracy in recording and posting. A balance sheet is a statement that shows all the assets and liabilities and equity of a company and is used to ascertain its financial position on a particular date.

10. What is the Possible Way for a Company to Show Positive Cash Flows and Still be in Trouble?

It is an unsustainable improvement in working capital and includes a lack of income going forward in the pipeline.

11. Name the Major Errors in Accounting?

The very common error in accounting are-error of omission, errors of commission, errors of opinion, and compensating error.

12. Difference Between Inactive and Dormant Accounts?

Inactive accounts are the account that is closed and will not be used in the future. Dormant accounts verbally are not currently functioning but they may be used in the future.

13. What are the Accounting Standards? How Many are There in India?

As per the Accounting Standards Board (ASB) they are 41 accounting standards-check for standard again. [ This is again a regularly probed query in the accountant Interview question ]

14. Is Accounting Standards Mandatory?

Yes, it is its plays a very important role in the business field for preparing a good and accurate financial report. It also ensures the consistency and application in a financial report.

15. How have you Helped the Company save its Money or use the Financial reSource Effectively?

You can through your ideas that helped the company’s finance positively. Also, tell them how your idea has optimized the process of how you came to such a decision through historical data review.

16. Does Your Company Have Three Bank Accounts for Processing Payment? What are the Minimum ledger Accounts Required?

For the accounting and reconciliation process we need three ledger accounts only.

17. Name the Ways we can Estimate bad Debts? One More Common Enquired Inquiry Accountant Interview Question?

The most popular ways of estimating bad debts are a percentage of outstanding accounts, aging analysis, and percentage of credit sale.

18. What is Deferred Tax Liability?

Deferred tax liability is defined signifies a company may pay more tax in the future due to current transactions.

19. What are the Ceferred Tax Asset and the Value Created?

Is a tax asset when the tax amount has been paid or carried forward but has not been recognized in the income statements the value is created by making the difference between the book income and therefore the taxable income.

20. Define the Equation for Acid-Test Ration in Accounting?

Equation for Acid-test ration in accounting is-

(Current assets – Inventory) / Current Liabilities.

21. Name the Popular Accounting Applications?

There are many apps you can tell the app you are familiar with like CGram Software, Financial Force, Microsoft Accounting Professional, Microsoft Dynamics AX, and Microsoft Small Business Financials.

22. Which Accounting Application you wish the Foremost and why?

I Like Microsoft Accounting Professional the best as it offers consistent and fast processing of bookkeeping transactions thereby saving time and increasing ability.

23. What is GST?

It’s an acronym for Goods and Service Tax and it’s an Indirect tax other than the income tax. Seller’s charges to the customer on the value of the service or product sold. The seller then can deposit the GST to the government.

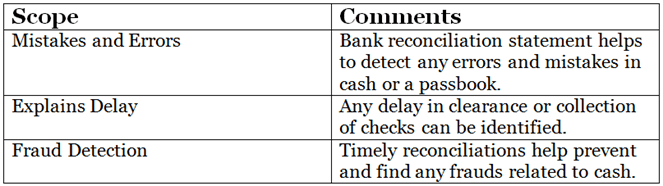

24. What is Bank Reconciliation Statements?

Bank Reconciliation is a statement that allows in the form of individuals to compare their bank account records to that of the bank. BRS is developed during these passbook balance changes from one cashbook balance.

This is a repeatedly asked accountant interview questions

25. What is Tally Accounting?

It is a software accounting used by small business shops to manage routine accounting transactions.

26.Define Fictitious Assets?

They are intangible assets and their benefits are derived from a longer period.

Eg: Goodwill, rights, deferred revenue expenditure, miscellaneous expenses, and accumulate loss among others.

27. Explain the Basic Accounting Equation?

Since accounting is all about assets, liabilities, and capital. Its equation can be summarised as

Assets = Liabilities + Owners Equity.

28. Name the Branches of Accounting?

There are 3 branches of accounting

- Financial Accounting

- Management Accounting

- Cost Accounting

29. Meaning of Purchase Return in Accounting?

It’s a return in a transaction where the buyer of merchandise inventory or fixed assets returns these defective or unsatisfactory products to the seller.

30. What is Retail Banking?

Retail banking and consumer banking involves a retail client where the individual’s customers use local branches of larger commercial banks.

These are the Repeatedly asked Beginner-accountant interview questions.

Join our specialized accounting and taxation course for a successful start to your career in Financial Accounting

Intermediate Level Accountant Interview Questions

1. Why did you Choose the Accounting Profession?

I decide to choose this field since I was very interested in learning more about numbers in various forms. Since I have scored well in my master’s I decided to take this field as my profession.

This is a collectively questioned in an accountant Interview question

2. Have you Worked Anywhere Before?

Yes, I have worked as an accountant in two different places.

3. Have you Used any Accounting apPlications Before or you Prefer Working Manually?

Yes, I even have used Advanced Business Solutions and AME Accounting Software in my previous jobs.

4. Name any Other Accounting Application?

A few of the applications that I remember are CGram Software, Financial Force, Microsoft Accounting Professional, and Microsoft Dynamics AX.

5. Name the Accounting Application you Prefer and Why?

All the statements do ideal only Microsoft Accounting Professional does most useful because it allows secure and firm processing of accounting activities that free account and build knowledge.

6. Define the Debit and Credit ion AcCounting Term?

The abbreviation of Debit is “dr” And Credit is “cr”.

7. Name the Types of Business Transactions in Accounting?

There are two sorts of transactions in accounting i.e. Revenue and capital.

8. What is the Balance Sheet?

It’s a statement that states the liabilities and assets of the company at a certain point.

9. Expand the TDS, What it is?

TDS abbreviation is Tax Deducted at Source.

10. Do you Know About Service Tax or Excise?

It’s a hidden tax that is included in the service provided by the service provider and paid by the service receiver.

11. Define Tally Accounting?

It’s an accounting method used in small businesses and shops for managing accounting transactions.

12. What is Departmental Accounting?

It’s a separate account created in the department.it is managed separately as well as shown independently in the balance sheet.

13. What do we Mean by Perpetual or Periodic Inventory?

In the perpetual inventory system, the accounts are adjusted continually. In the periodical file way, these statements are changed annually.

14. What does Premises in Accounting mean? Regularly asked Accountant Interview Questions?

It refers to fixed assets that are shown in the balance sheet.

15. Abbreviation of VAT in Accounting?

It means the Value added tax.

16. What is ICAI?

The abbreviation is the Institute of Charted Accountants in India.

17. Explain the Basic Accounting Equation?

Since we all know accounting is bout assets, liability, and capital, therefore, the accounting equation is:

Assets=Liabilities Owners Equity.

18. What is Executive Accounting?

It’s an account that is specially designed for the business that offers services to users.

20. Describe CPA?

It stands for Certified Public Accountant. To become CPA There e many qualifications as well. It is qualified with 150-hour requirements. It means that we should completer 150 credit hours at an accredited university.

22. Differentiate Public Accounts and Private Accounts?

Public accounting may be a sort of accounting that’s done by one company for an additional company. Private accounting is done for your own company.

23. Name project implementation?

It involves six steps they are:

- Identify Need

- Generate and Screen Ideas

- Conduct Feasible Study

- Develop the Project

- Implement the Project

- Control the Project

24. Name the Branches of Accounting?

There are 3 main branches of accounting they are

- “Financial Accounting”,

- “Management accounting”

- “Cost Accounting”

25. Difference Between Accounting and Auditing?

Accounting is all about recording the daily business activities while auditing is that the checking whether these events are written correctly or not.

26. Term the Dual Aspect Term in Accounting?

The name itself states that it has two sides to transactions. For example, once you buy something, you give the cash and obtain the thing. Similarly, when you sell something you lose the thing and get the money. So this getting and losing are basically two aspects of every transaction.

27. What do you Mean by Purchase return in Accounting?

It is a term introduced in the records for every defective or unsatisfactory good returned back its supplier.

28. Outline Material Facts in Accounting?

Material facts are bills or any document that becomes the base of every account book. It means all those documents, on which the ledger is ready are called material facts.

29. Have you Ever Worked on MIS Reports and What are These?

Yes, I have prepared a few of them in my previous jobs. MIS reports are very creative to identify the efficiency of any department of a company.

30. State Company’s Payable Cycle?

Company takes time to pay all the accounts payable in that period.

31. Define Balancing in Accounting

Balancing means to equate each side of the account, i.e., the debit and credit sides of an account must be equal/balanced.

32. What Proportion of Statistics Knowledge is Important or Required in Accounting?

You must be excellent at statistics if you would like to try to well in accounting. Otherwise, with minimum knowledge, you can’t manage your day to day transactions effectively in accounting.

33. Define Scrap Value in Accounting?

This means the remaining amount from an asset. The remaining amount is the amount that an asset exists after its expected lifetime.

34. What is the Marginal Cost?

Marginal cost is defined as an increase or decrease in the cost of producing units or serving customers.

35. Define Partitioning in Accounting?

It is a sort of group made supported by an equivalent response by a system.

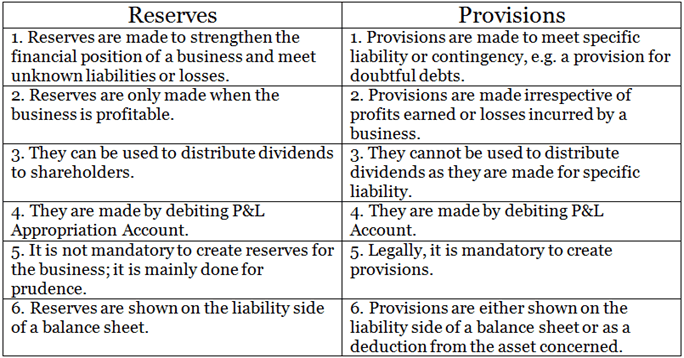

36. What is the Key Difference Between Provision and Reserve?

Provisions are the liabilities or the anticipated items, such as depreciation. In contrast, Reserves are the profits of any company, placed back to the business to stay it sustainable in tough times of a corporation.

37. Define Offset Accounting?

Offset accounting is one that decreases the internet amount of another account to make a net balance.

38. Define Overhead in Terms of Accounting? Very Frequently Asked Accountant Interview Questions?

It is the indirect expenditure of a corporation like salaries, rent dues, etc.

39. Define Trade Bills?

The business checks are considering reports made against each step.

40. Define fair Value in Accounting?

Fair value is the measurement of liabilities and assets according to the current value of the market. This gives the expected rate at which each asset is disappointed. Liability shows third-party transactions under the present condition of the market.

41. What is a Compound Journal Entry?

A compound journal entry is simply like other accounting entries where there’s quite one debit, quite one credit, or quite one among both debits and credits. It is essentially a mixture of several simple journal entries.

42. What are the Accounting Events that are Frequently Involved in Compound Entries?

These accounting issues that are usually required in compound entrances are:

- Multiple line items during a supplier invoice that address to different expenses

- All bank deductions associated with a bank reconciliation

- Deduction and payments related to a payroll

- Account receivable and sales taxes associated with a customer invoice

43. Mention the Kinds of Accounts Involved in Double-Entry Book-Keeping

Double-entry book-keeping includes five types of accounts:

- Income accounts

- Expense accounts

- Asset accounts

- Liability accounts

- Capital accounts

44. What are the Principles for Debit and Credit for Various Accounts to Extend the Quantity in your Business Accounts?

The rules for debit and credit for various accounts are:

- A capital account, credit to extend it and debit to decrease it.

- An asset account, debit to extend it, and credit to decrease it.

- Liability account, credit to extend it, and debit to decrease it.

- A travel and entertainment account, debit to extend it, and credit to decrease it.

- For an income account, credit to extend it and debit to decrease it.

45. List out the Stages of the Bouble-Entry Bookkeeping System

The stages of the double-entry system are:

- Recording of transactions in the journal

- Posting of a journal entry into the respective ledger accounts then preparing an attempt balance

- Preparing final accounts and shutting of books of accounts

46. What are the Disadvantages of a Double-Entry System?

The disadvantages of the double-entry system are:

- If there are any compensatory errors, it is difficult to find out by this system. This system needs more clerical labor.

- It is difficult to find errors if the errors are in the transactions recorded in the books. The double-entry system is not preferable to disclose all the information of a transaction, which is not properly recorded in the journal.

47. What is the General ledger Account?

The general ledger account is an account won’t to record all the knowledge. It is often expenses and income types that are recorded into separate accounts.

In this account debits and credits, transactions are entered in one place and kept balanced.

48. What is the General Classification of Accounts that Usually Ledger Account Involve?

The general classification of accounts that sometimes ledger account involves are:

- Assets: cash, accounts receivable

- Liabilities: accounts payable, loans payable

- Stockholders’ equity: common stock

- Operating revenues: revenues through sales

- Operating expenses: rent expense, salaries expense

- Non-operating revenues and gains: investment income, gain on disposal of kit

- Non-operating revenues and losses: expense, loss on disposal of kit

49. List Things Will not be Included in a Bank Reconciliation Statement?

Things will not be included in a bank reconciliation statement are:

- Cheques dishonored not recorded in the cash book

- Close returns caused by the group not listed in Cashbook

- Bank Charges or Interest debited by the bank.

- Cheques deposited but not cleared.

- Wrong debits are given by the bank.

- Banks direct payment not entered in Cashbook.

50. When are the Revenues Reported in the Accounting Period?

Revenues are reported within the accounting period when service or goods are delivered.

These are the Frequently asked Intermediate Accountant Interview Questions

Expert Level Accountant Interview Questions

1. What is the biggest Challenge that you Face in the Accounting Profession Today?

There is no such solution that you can answer this question but you should be able to demonstrate knowledge of commitment to your profession in such a way you are familiar with the industry and its challenge. And that you care about your job enough to possess an opinion.

Example: In recent time there were some changes to the tax code are one of the big challenge for the industry since we have to go through all the new rules and regulations. And responding accordingly to new tax laws is familiar to the accounting industry. In this field another major issue is technology. It is available online accounting service can make the role of a seasoned professional seem less essential. This means as accountants, we have to offer clients something that a system cannot offer in knowledge-wise.

2. Name the Applications that you are Familiar With?

What they won’t know: there are several applications that everyone could know them all. Interviewers are looking to see if you are aware of more than one application and have knowledge about the tools and profession. As well as mentioning the ones you prefer (and why), you can also speak about recent developments in relevant software.

Example: If you are most familiar with ABC company name accounting software, since that is what I use day-in and out In my last organization. You could also inform about the X and Y application that you have used in the other roles. And after a former co-worker recommended it, I recently started an online course on how to use the Z application for business.

3. What is the Advantage and Disadvantage of Different Accounting Packages you have used in Your Most Accountant Jobs?

These free very tricky questions you should be prepared to answer them in a specific manner with the example of the pros and cones of the accounting software you’ve used. Your response will show interviewers your knowledge as well as your critical thinking and assessment skills.

Example: I found the usability and price of ABC accounting appealing. I was however frustrated with the whole process of some missing functionality, which comes standard with the popular packages like XYZ and XXX.

4. Define any Accounting Process that you’ve Developed or Sought to Improve?

If you have just started your career, you may have not developed any processes yet. But one should be ready to demonstrate that you can innovate. Believe of something you’ve sustained move or increase up the prior few ages

Example: In the role that you played in your previous job, you would have discovered how to handle company and travel reimbursement for the sales team was so difficult and time consuming that everyone expense reports came in late, We can use an application that we downloaded on all company-provided phones, and since we transitioned to this new process reports have been timelier.

5. How have you Helped Reduce Costs in a Previous Accounting Job?

All the accountant should be able to reduce costs that the major part of why employers hire them. Describe a time when you reduced costs unexpectedly through your revolution or diligence. Have the financial details of your success available just in case the interviewer asks you to elaborate.

Example: the unused license to software programs that charge a per-license fee which cuts most of the significant sum of budget. I have used software that has tried to understand every department program’s services were in use. We also discovered that several departments had purchased that did essentially the same task we realized that we were paying more for the licenses that were being used. I analyzed to uncover that streaming our program could result in a 15% saving in the budget and presented in finding the executive board.

6. When is the Time When we had use Numerical data to a Graph to Convince a Manager?

You can discuss a few things that how data, chart, graph helped the company outcome in their favor.

Example: for several years my organization has been turning to an equivalent vendor and stock paper products. Annual deposit of accelerating moves faraway from paper and toward the web communication the general price we paid went up high. My manager wasn’t able to dissolve the connection because finding a replacement vendor was challenging. I showed a chart of the year-over-year increase along with side researching alternatives and getting bids for service and showed her that we might be saving 40% on these costs. Seeing the info laid out was tremendous.Ans this properly in Accountant Interview

7. What’s the Time Once you Had Figure Exceptionally hard to Supply Great Service to Customers or Clients? What did u do?

They might wish to know if you’re willing to figure hard and go that extra mile to figure beyond the period you’ll share information on what you probably did what information you provided and the way did you accomplished it.

Example: So you’ll share a touch little bit of what you’ve got accomplished in your previous organization. Like in my previous company we had a client who had little business his business was running fine but he wasn’t that keen on keeping a track of all his financial records albeit being in business since he was very busy and didn’t want to rent anyone because it was a little business.

So I explained how the software can work which I did provide training sessions in four sittings he was ready to understand and that worked miracle in managing his bookkeeping records then he introduced other small business firms that he knows who also was interest in learning the tactic of book-keeping.

8. Was There any Deadline that you Simply Faced in Completing the Financial Statements or any Deadline for that? How did you Complete the Work?

In every accountant field, time management plays a crucial role where we’ve to affect multiple deadlines throughout the year. Ready you’ll provide a glimpse of your experience and therefore the way smoothly you were ready to complete your work. Which might be seen as but honest by your interviewer.

For example, the foremost important deadline that I can remember was while preparing the year-end financial report. In the previous ABC Company that I worked for, we had to finish the FY report that involved tons of labour and there are many dependencies on the opposite team members by providing data from their departments.

The great thing is everyone knows how important it’s to make and present the findings during this report. My co workers were good at completing their work within the deadline so, during this case, I had a couple of more days if we had to try to some changes.

9. In what way did you Make Sure that you don’t Forget Details and Make Sure the Accuracy once you Prepare the Monthly Journal Entries, Record Transactions, etc?

Most everybody ignores little items sometimes but analysts, who can’t stand to. Give your strategy for creating sure you are doing not forget or unintentionally alter records. You’ll say that you���re not disposed to mistakes in your response or that you’re good with details but attempt to go a touch deeper into it.

Example: On my computer, I even have a sticky note that says “Check-then double-check. “It’s a reminder on behalf of me to trace all the littlest work that I’m doing so my work is usually accurate. on behalf of me to recollect everything I do few things like I automate the tasks the maximum amount as possible also I exploit calendar reminders and an honest old-fashioned list to form sure that I remind myself to try to tasks so that nothing is lost in my inbox. Answer carefully in Accountant Interview

10. Define a Time once you had to Elucidate a Posh Accounting Subject to Somebody Without an Accounting Background. How did you Help your audience Comprehend the Situation? Did best ask Accountant Interview Questions?

Your skill to speak with non-accountants could also be very significant, particularly if you’ll be during a consultative role with direct contact with clients or with team followers from other sections. When returning, emphasize your communication skills and storytelling talent, also as your capacity to figure as a part of a team.

Example: I even have noticed tons of that several that a lot of people get overwhelmed once you throw a lot of facts and figures at them. So in my last meeting with a little business owner to share strategic advice. I not just produced a PowerPoint exhibition, but I too gave a printed version. After my exhibition, I gave the customer quarter-hour to review the summary, then we were ready to have a conversation supported a mutual acceptance of the financial matters.

11. Define Dual Aspect Term in Accounting

Because the title suggests, the double character theory says that every transaction has two sides. For instance, once you purchase something, you give the cash and acquire the thing. Similarly, once you sell something, you lose the thing and obtain the cash. So this winning and losing are a couple features of each event.

12. What can we Mean by Purchase a Return in Accounting?

Purchase return could also be a term used to record every defective or unsatisfactory product returned to its supplier.

13. Define the Term Material facts in Accounting

Material facts are the bills or any document that becomes rock bottom of every ledger. It means all those documents, on which ledger is prepared, are called material facts.

14. What are the MIS reports?

MIS reports are created to identify the efficiency of any department of an organization.

15. Define a Company’s Payable Cycle?

This is the period needed with the business to meet all its record payables.

16. Define Retail Banking?

Retail banking may be a sort of banking that involves a retail client. Those customers are regular characters and not any organizational clients.

17. What Proportion of Mathematics Knowledge is Vital or Required in Accounting?

Not much knowledge, but the essential mathematical background is required in accounting for operations like addition, subtraction, multiplication, and division.

18. Define Bills Receivable? Very Commonly asked Accountant Interview Questions?

All kinds of trade currencies, bonds, and other contracts held by a dealer that’s due to him are said as notes receivable.

19. Define Depreciation and its Types?

Depreciation is often defined because the value of an asset that’s decreasing because it is in use. It’s two types, such as:

- Line method

- Diminishing value method

- Annuity method

- Depletion method

- Written down value method.

20. Differentiate Between Consignor and Consignee?

The consigner is that the owner of the products, otherwise you’ll say he’s the one that delivers the products to the consignee. The consignee is the one that receives the products.

Part 01: Core Accountant Interview Questions

01. What are the Prerequisites of Revenue Recognition?

Credits package be accepted just at this next rules are met:

There does an adjustment among the user meaning that this business is thought to use home. That system support is in the frame of contractual negotiation, a possession system, or an email verifying that the user is putting an application. The delivery of services or products is completed.

Credits package be remembered for not produced assets or assistance. The price of the services or products can be determined with certainty. Credits package be remembered for not produced assets or assistance. The price of the services or products can be determined with certainty.

Credits package be remembered for not produced assets or assistance. The price of the services or products can be determined with certainty.

This method specified in detail:

- We will usually consider the cost of the goods/assistance. If no when the business value can be done as well.

- Revenue collection can be fairly determined. For clients with whom business is done in the past, data analysis of previous receivables can be used to determine the timely receivable of collections.

- For current customers, confidence numbers, market status, books can be compared to ascertain the possibility of finding.

02. How Important is Documentation When it Comes to Accounting?

I believe that the accounting team of any company has the responsibility of presenting a true and fair view to the shareholders and the management of the company. The accounting team is like the watchdog of the organization. That is how? Documentation matches so essential in accounting. Proper documentation requires to be monitored and controlled so that a proper audit trail is maintained and justified as and when required.

03. What are Accounting Values?

To financial statement meaningful, comparable, and statutorily compliant, there are a set of standards which need to be followed by all business while maintaining their books of accounts. These are more like a set of rules to be followed so that financial statements of different organizations are made on the same lines. So the users of the financial statements know the assumptions behind the financial statements and can easily compare the financial statements across companies and sectors.

04. What is a FIXED ASSET Register?

A fixed asset register is a document/register which maintains a list of all fixed assets available with the organization. This is said historically also it additionally includes data of assets that do sell/written off. Some of the important details to be mentioned in the FAR are the date of acquisition of an asset, cost of acquisition, rate of depreciation, accumulated depreciation to date, depreciation for the current period, selling price of the asset if any, date of transfer, location.

This asset (in fact of many company areas, this field is important), asset number (a unique asset number should be assigned to every asset for ease of tracking. That means exceptionally effective for assets wherever capacity is larger than 1 like laptops).

05. List Down Important Cost Control Techniques?

Important cost controlling techniques are:

- Budgetary control

- Labor control

- Material control

- Standard costing

- Overheads control

06. Mention Whether the Account “Cash” is Going to be Credited or Debited When a Corporation Pays a Bill?

The account “Cash” is going to be credited when a corporation pays a bill.

07. What are Assets Minus Liabilities?

Assets minus liabilities are defined as:

Assets minus liabilities = owners’ equity / stockholder’s equity.

08. List the Three Basic Elements of Cost

The three essential components of value are:

- Material

- Work

- Costs.

9. What is the Main Difference Between Accumulated Depreciation and Depreciation Expense?

The distinction among accrued discount and reduction time is that Accumulated depreciation is that the total amount of depreciation that has been taken on a company’s assets up to the date of the record. Depreciation expense is the amount of depreciation that’s reported on the earnings report.

10. List out Several Examples for Liability Accounts?

Some of the examples of liability accounts are:

- Accounts payable

- Accrued expenses

- Short-term loans payable

- Unearned or deferred revenues

- Installment loans payable

- Current portion of long-term debt

- Mortgage loans payable

11. How to Adjust Entries into Account?

Entries are often adjusted under consideration by sorting entries into five categories:

- Accrued expenses: Expenses have been incurred, but the vendor’s invoices are not generated or processed yet

- Increased revenues: Returns have passed been collected, without the selling statements are no made or prepared yet.

- Charged means: Payment did take in the approach of having been paid or earned.

- Charged fees: Cash was given for a planned time.

- Reduction rate: An asset acquired in one time must be allotted to expense in all of the accounting terms of the asset’s valuable time.

12. Explain Deferred Assets with Example?

A partial asset transfers to a delayed entry or an assessed price. An example of a deferred charge is bond costs. These costs involve all of the fees or charges that an organization incurs to register and issue bonds. These fees are paid in the near time when the bonds are issued, but it will not be expensed at that time.

13. What is Bank Reconciliation?

Ans: A bank reconciliation may be a process done by a corporation. It ensures that the company’s records are correct and that the bank’s records are also correct. These records are often register, record, a ledger account, etc.

14. What is “deposit in transit”?

Ans: A deposit in transit is a check or cash that has been received and recorded by an entity. It should not yet be entered in the records of the bank where the funds are deposited.

2. Financial Analysis Interview Questions

1. Explain the Difference between Working Capital and Available Cash/Bank Balance?

Working capital is the day-to-day funds’ requirement for any business. Cash and bank balance may be a part of the entire capital availability of any organization. Working capital is much broader than just cash and bank balances. Current assets and liabilities also make up for the working capital of the business.

Let me explain through an example. Let us assume at $ 5000 is receivable from a debtor on 1-Apr-17 and $ 4000 is also payable to a creditor on the same day. However, your organization does not have sufficient cash or bank balance to pay off the debtor. The simple solution to this problem is to recover the funds from the creditor and pay the same to the debtor. This is how the day-to-day fund requirements of the corporate get managed by maintaining appropriate capital which requires not only be balanced in the bank or take advantage of hand. This is a regularly asked accountant interview questions.

2. Assume you are Given Financial Statements of Three Different Competitors. You are required to Ascertain Which of These Three is in the Best Financial Shape. What are the two Main Parameters that you will use to Judge?

The two parameters which I would like to check are:

a) Correlation between revenue and profit of the organization – a corporation with a better revenue isn’t necessarily doing well.

E.g. allow us to say that the revenue of Company A is $ 1000 but against which it’s booked heavy losses. On the other hand, Company B is only $ 500 but it has already broken even and is earning a profit of around 7% of total revenue. Needless to say that Company B is more efficient and profitable. The management of this company is moving in the right direction. More the profit, the better will be the dividend declared for its shareholders and better capacity to pay off the debt and interest.

b) Debt-equity ratio – A proper balance needs to be maintained between the two – debt and equity. Only debt means high-interest costs. Only equity means the corporate isn’t leveraging the opportunities available within the marketplace for lower interest rates.

Tip 1: Liquidity is additionally another parameter which may be mentioned if required. For this, you can calculate the working capital of each company and make conclusions. This effective letter should not do too great which happens in blocking of funds of the company nor should it be too low which will not fulfil its day to day funding requirements.

Tip 2: Meeting education should involve some knowledge about important rates of the assigned business also for the company’s competitors. The above question when answered with the ratios will create a bigger and better impact on the interviewer.

3. You Mentioned that MS Excel will be your Best Friend, Give us Three instances in Which Excel will Make your life Easier?

Various reports can be extracted from the ERP. However, many times reports are required in specific formats and this may not be possible in the ERP. This is where excel comes into the picture. Data can be sorted, filtered, redundant data fields can be deleted and the data can then be presented in the customized format.

Excel is also required for linking multiple sets of data. So different reports can be extracted from the ERP and then using the VLOOKUP in Excel/lookup function they can be clubbed into one report.

The use of Excel becomes the most important for doing various reconciliations. These cannot be done in the ERP. E.g. if I need to do a vendor ledger balance reconciliation, I will extract the vendor ledger from the ERP in Excel and get a similar Excel from the vendor for his ledger. All the reconciliations will then have to be done in Excel only.

Also, most of the organizations make their financial statements in Excel as they have to adhere to the specific statutory format which may not be extracted from the ERP. So again Excel acts as a savior, in this case, MS Excel Training. This is also a Regularly asked accountant interview question.

04. Suggest Improving the Working Capital flow of the Company?

According to my, stock-in-hand are often the key to improving the capital of the corporate. Out of all the components of working capital, the stock is controllable by us. We can pressurize our debtors to pay us instantly but we cannot have direct control over them because they are separate legal entities and in the end, they are the ones who give us business.

We can tend to delay payments of our suppliers but it spoils business relations and hampers the goodwill in the industry. Plus if we delay payments, they could not supply goods within the future. Keeping liquidity in the form of funds in the bank can help the working capital flow but it comes at an opportunity cost.

Keeping all this in mind, I believe that inventory management can go a long way in improving the working capital of the company. Excess stocking should be avoided and the stock turnover ratio should be high.

This answer is also generic. Some industries work on negative working capital as well such as e-commerce, telecommunication, etc. So please do a touch of research about capital before answering.

05. What does the cash flow statement about the company?

It is very interesting to correlate the cash flow statement and the profit and loss statement of the company. What i’m trying to mention is, high revenue doesn’t mean that the corporate features a high availability of money. At an equivalent, if the corporate has excess liquid cash, it doesn’t mean that the corporate has earned a profit.

Cash flow shows how much CASH the company has generated in the given year. It can also show if the company is in a position to pay for its operations shortly. This helps to answer what investors want to understand before investing – will the corporate be ready to pay the interest/principal/dividends as and when due? Earning profit is one thing but ready to generate cash when the corporate must pay its debts is another thing.

The cash flow statement has three segments – Cash Flow from operations, Cash Flow from investing activities & Cash Flow from financing activities. Operations associated with day-to-day operations which help the corporate earn revenue. Investing activities show the company’s capital expenditure. Financing activities show activities like borrowings, shares issues, etc.

06. What is the Financial Impact of Buying a Fixed Asset?

Talking from the budget point of view the subsequent are going to be the impact:

Income Statement – Buying won’t have any direct impact on the earnings report. However, year on year you will charge depreciation as an expense to the income statement.

Balance Sheet – Fixed assets will increase whereas current assets (cash paid) will decrease if the payment is formed within the same fiscal year. If the payment is not made in the same financial year then instead of a decrease in current assets, there will be an increase in current liabilities. Also, every year, when depreciation is charged to the income statement, the asset will be reduced.

Cash flow statement – There will be a cash outflow that will be shown under the cash from investing activities section of the cash flow statement.

07. What is an over accrual?

An over accrual may be a condition where the estimate for an accrual journal entry is just too high. This evaluation might remove to the addition of expenditure or income.

08. What is the account receivable?

A short term amounts due from buyers to a seller, who have purchased goods or services from the seller on credit is referred to as account receivable.

09. What are the Activities that are Included in the Cash Flow Statement?

The income statement showcase the cash generated and used during the year or months. Various activities that are involved for the income are:

- Operating activities: Business activities accounting to cash

- Participating actions: Deal and obtaining of tackle or stuff

- Economic actions: Buying of standard and individual words

- Additional material: conversation of significant items that don’t include money

10. What Happens to the Company’s “Cash Account” if it Borrows Money From the Bank by Signing a Note Payable?

Due to double-entry bookkeeping, the “cash account” will increase intrinsically the liability account increases.

11. Which Account is Liable for Interest Payable?

This report which means liable or influenced by the benefit due is “Modern debit statement.”

12. What’s Reversing Journal Entries?

Reversing journal Gentries are entries made at the beginning of an accounting period to wipe out the adjusting journal entries. These entries are made at the top of the previous accounting period.

13. Where do General Accruals Appear on the Balance Sheet?

Accrued expenses usually tend to be extremely short-term. So you’d record them within the “current liabilities section” of the record.

14. List out a number of the accrued expenses and therefore the accounts to record them?

Accrued expenses and therefore the accounts are:

Income increase is moving in with a recognition of the “wages allocated account. Notice increase has arrived with acclaim to the “attention owed explanation. “Staff tax accrual is reached with a credit to the “staff duties owed explanation.”

15. Deferred Taxation may be a Part of Which Equity?

Deferred taxation may be a part of the owner’s equity.

3. Personality Accountant Interview Question

1. What are the Challenges Faced by an Accountant?

An accountant has got to coordinate with various teams like customer supporting, marketing, procurement, treasury, taxation, business development, etc. I might say that the supply of data/details/documents from these teams on a timely basis may be a key challenge faced by an accountant. As already mentioned, documentation plays a key role in accounting, and without proper documentation, an accountant won’t be ready to post entries within the accounting. Also, delay in accounting isn’t appreciated by the management as updated reports / MIS are created from these accounting records.

2. If you get this Job, What is Going to Your Routine Day of 8 Hours be Like?

I believe the accounting ERP employed by your organization and Microsoft Excel are going to be my best friends and that I am going to be spending maximum time with these two applications at work.

A routine day will invoice the subsequent core activities:

- Posting various journal entries within the ERP

- Extracting/maintaining/updating different reports which are required by the management (some of those reports are an inventory of payable amount for subsequent 3 working days, fund position at the top of the day, debtors aging report, etc.)

- Scrutiny and reconciliation of various ledgers

- Checking invoices and other supporting documents required to be a part of the invoice

- Coordinating with different teams for documents / data / details

The above answer is extremely generic. This could be fine-tuned as per the precise description. Allow us to say you’re applying for the position of assets Accountant. During this case, you would like to say revenue reports, follow up with customers for payment whenever due, revenue recognition, raising invoices to customers, etc. On the opposite hand, if the profile is that of Accounts Payable Accountant then you would like to say purchase orders, materials receipt, and releasing payment of vendors on a timely basis, etc.

3. If you’re Made the CFO of this Company, What are the Changes you’d Wish to Recommend to the Board of Directors of the Company?

This is a difficult question and wishes to be answered with care. It’s tricky to answer this because change is suitable to most organizations only it leads them on the trail of progress. Being the CFO may be a lot of responsibility and once you directly mention changing things within the organization you’re not even a part of, it can show tons of arrogance on your part. At an equivalent time not eager to change means you’ll be easily bent which again not an honest trait is for a CFO. Therefore the answer should be framed as follows:

Being the CFO of the corporate, my first task is going to be to know the business, the revenue model, the processes followed at a broader level, and getting familiar with the management and therefore the team reporting to me. I think that before suggesting any changes, knowing this stuff is extremely important. Once I spend enough time within the system, I might then be in a position to suggest changes that supported industry best practices, responses to the competitors, and shareholder expectations.

4. Tell me Something About Yourself?

This question isn’t asked by interviewers to understand your background. They have already got your resume right ahead of them which states the facts about your academic and work experience background. You ought to not repeat this stuff e.g. I even have completed Graduation with 85% or I even have done my Masters in Accounting from XYZ College isn’t what the interviewer wants to listen to. The interviewers want to understand what causes you to a correct fit for the given job and whether you’ll be ready to take the responsibility related to the work.

So, rather than mentioning this stuff which the interviewer already knows, use this question as a chance to inform them things about your work experience and your achievements. Properly framing this answer is that the key to cracking the accounting interview. Start together with your best achievement and tell them why you’re keen on what you’re doing and eventually how you are best at your job.

5. Share a Stressful Situation you have been a part of and how have you Handled the Situation? Regularly Asked Accountant Interview Questions?

This accounting plus investment area is below even strength. It is not a job that can be taken lightly which is why the interviewers ask these questions to test your composure under such stressed times. Take care to say a genuinely stressful situation and don’t crib about the work pressure you’ve got faced on each day to day basis as nobody wants to hire someone who cannot handle work pressure.

Also, please be realistic about the stressful situation you mention. It should not sound fake. The situation is often that of employee fraud, massive damages to the corporate on account of natural calamities, tax scrutiny of years where you weren’t even a part of the organization, etc.

Senior Accountant Interview Questions

Senior Bookkeepers make correct and appropriate economic declarations and brochures. People remain liable for making stability sheets, revenue, expense, and payroll account reconciliations, as well as executing accounts payable and accounts receivable processes. Senior Accountants provide leadership for Junior Accountants by teaching them the way to complete complex financial operations. Senior Accountants analyze financial statements for discrepancies.

A great description starts with a compelling summary of the position and its role within your company. Your summary should provide a summary of your company and expectations for the position. Outline the kinds of activities and responsibilities required for the work so job seekers can. Determine if they’re qualified, or if the work may be a good fit.

Example of a Senior Accountant job summary

We need a Senior Bookkeeper to catch our money section and income ended the foremost broadcasting and settlement responsibilities for our business. We’re a rising, advanced net of car charters specifying in fleet automobiles and profitable cars. The Senior Accountant is going to be liable for heading the finance department and reporting on to the CFO. We need knowledgeable with inherent leadership qualities and therefore the attention to detail necessary to make sure accurate reporting altogether areas. The successful applicant will have a basic knowledge of how dealerships are run and can have prior experience with tax issues.

List of Senior Accountant Interview Questions

1. List down the Errors Which Affect balance And Errors Which don’t Affect Trial Balance?

- Mistakes that change the balance of action judgment

- Wrong totaling of subsidiary books.

- Posting on the wrong side of an account

- The omission of posting an amount in the ledger

- Posting of the wrong amount

- Error in balancing

- Mistakes which don’t change the understanding of trial balance:

- Error of Principle

- Errors of Omission

- Errors of Commission

- Recording of the wrong amount in the books of prime entry or subsidiary books.

- Compensating Errors.

To locate the errors within the balance follow the below steps:

- Check the entire of all the subsidiary books, cash books, and balance.

- Ensure that all the opening balances are correctly brought forward within the current year’s books of account.

- Ensure that all the ledger accounts are properly balanced and therefore the balances of all the ledger accounts are reflected within the balance.

The difference in balance should be halved to locate such errors.

If the difference within the balance is divisible by 9 with none reminder, it’s going to indicate the transposition or Trans placement of the amounts.

The balance of the present year is often compared with the balance of the previous year to locate a certain highlighting error.

2. What are the Important Terms Utilized in the Record?

- Current assets and fixed assets

- Tangible assets and Intangible assets

- Equity may be a claim which may be enforced against the assets of the firm within the court. Thus equity refers to a claim held by owner only, a creditor only, an owner, and the creditor both.

- Liability

- Current Liability

- Long term Liability or fixed Liabilities

- Contingent Liabilities

3. Why Is It Easier for Somebody To Perpetrate Fraud Employing a Journal Entry than with a Ledger?

Accounting professionals, particularly people that have managed ledgers or had jobs as full-charge bookkeepers for quite a few years, should be ready to speculate on this scenario. A candidate with more proper training specific to checking or fraud analysis will likely explain this thoroughly and be ready to provide examples.

4. Which Enterprise Resource Planning (ERP) Systems have you ever Used?

Most professionals, especially those with experience working for medium to large organizations, should have a solution for this.

A reply might include any of the following: Hyperion, Microsoft Dynamics GP, or Oracle Enterprise Manager. For entry-level candidates, you’d possibly turn this into a discussion of accounting certifications and upcoming training possibilities. As an example, ask which ERP systems they could wish to master. Discussion of these tools, how the applicants learned them and put them to work, and what applications your company uses will reveal what proportion if any, training might be required.

5. What is the Difference Between an effort Balance and a Balance Sheet?

The balance could also be an inventory of balances from the ledger account while the record could also be a press release of assets and liabilities.

Trial balance contains balances of all personal, real, and nominal accounts, while the record contains balances of only those personal and real accounts which represent assets and liabilities.

It is prepared before the preparation of trading and profit and loss account, while the record is prepared after the preparation of trading and profit and loss account.

This is prepared to ascertain the arithmetical accuracy of posting into ledger while the record is prepared to point the financial position of the business on a selected date.

Debit and credit balances are shown side by side while the record is prepared on a T form basis, the left-hand side showing liabilities while right-hand side representing assets.

Closing stock doesn’t appear within the balance while it’s shown on the assets side of the record.

Business Accounting And Taxation Course

6. What do you Consider the Very Best Three Skills Of a Superb Accountant? Habitually asked Accountant Interview Questions?

Yes, you’re trying to seek out someone with numerical abilities, but not necessarily a mathematician. You furthermore may have someone with analytical know-how, who can communicate with others. Watch to answers that give a perception about the quality of general business experience, technology expertise, management skills, client assistance introduction, and specific knowledge that can connect on the part.

7. List the Items Are Included In Profit And Loss Account?

- Salaries

- Rent

- Rates and Taxes

- Interest

- Commission

- Trade Expenses

- Printing and Stationery

- Advertisement

- Carriage out, freight out, carriage out

- Repairs

- Traveling expenses

- Samples

- Depreciation

- Apprentice premium

- Life insurance premium

- Insurance premium

- Income tax

- Interest on capital and drawings

- Loss or gain on asset sold

- Discount received and allowed

- Trade discount

8. What’s The Adjustment Entries Made While Preparing the Ultimate Accounts from The Trial Balance?

- Closing Stock

- Depreciation

- Outstanding Expenses

- Prepaid Expenses

- Accrued Income

- Revenue received beforehand

- Bad Debits

- Provision for Doubtful Debts

- Provision for Discount on Debtors

- Interest on Capital

- Drawings

- Deferred Revenue Expenditure Written off

- Abnormal Loss thanks to fire etc.

- Goods distributed as free samples

- Goods sent on approval basis

- Commission payable to the manager

9. What’s the Bank Reconciliation Statement? What Are the Steps to Organizing it?

Bank reconciliation statements could also be a press release prepared at periodical intervals, to point the items which cause disagreement between the balances as per the bank columns of the cash book and therefore the bank passbook on any given date.

Follow the below steps to arrange a bank reconciliation statement:

- Take the balance either as per cash book or as per pass book as a start line.

- Compare the things appearing within the bank column of the cash book with the item appearing within the bank passbook.

- Tick off the things within the passbook with the entries within the cash book. An inventory of unpicked items either in cash book or passbook is going to be found.

- Add or deduct items from the balance which has been taken as a start line.

- The resultant figure is going to be the balance as shown by the passbook or the other way around.

10. What Are The Accounting Concepts?

Accounting concepts are the essential assumptions on which the tactic of accounting is based. Following are the accounting concepts

- Business Entity Concept

- Dual Aspect Concept

- Going Concern Concept

- Accounting Period Concept

- Cost Concept

- Money Measurement Concept

- Matching Concept

11. What Deferred Revenue Expenditure and Give Some Examples. ?

Deferred Revenue Expenditure could also be a kind of expenditure that does not end within the acquisition of any fixed asset and thus the advantages from such expenditure aren’t received during the amount which they’re purchased.

For example Original Announcement Expenditure, Research and Development Disbursement, Preliminary Costs.

12. What’s Accounting Ethics?

Answer: Bookkeeping morals is primarily a field of applied ethics, the study of moral values and decisions as they apply to accountancy. It’s an example of trained ethics.

13. What’s Creative Accounting?

Thinking external when such duplication isn’t allowable. Original accounting could also be an honest description of the practice because it tends to form a picture, which isn’t officially correct from the attitude of the evidence’s planned user.

14. What’s Fiduciary Accounting?

Proper accounting for the property that’s entrusted to the fiduciary acting under the conditions outlined during a deed.

15. What’s Accounting Transaction?

A business is an accomplishment of a user program and is seen by the DBMS as a sequence or list of actions. The actions which will be executed by a transaction include the reading and writing of the database.

16. What Are The Uses Of Journal In Accounting?

The journal is most commonly used to record corrections to errors that are made in writing up the general ledger accounts

17. What’s Account in Accounting?

Answer: An account may be a method that won’t visualize the debit credit accounting procedure. The account can represent any account no matter expense, revenue, asset, or liability. The debits are placed on the left side and therefore the credits on the proper. Consistently asked accountant interview questions.

18. What are Those Three Golden Rules about Book-Keeping?

First things first this is the most basic yet the easiest one to be taken for granted, know this well.

In bookkeeping, three golden rules of accounting are:

- Individual Account – Account the Receiver, Credit the giver

- Real Account – Debit whatever comes in, Credit whatever goes out

- Nominal Account – Charge all costs & needs, Trust all returns & increases Read this with samples here Three Golden Rules of Accounting with examples

Check for- Accounting and Taxation Certification Course

19. What are the three Main Types of Accounts?

They are Real, Personal, and nominal but wait. If don’t want to sound artificial and stand out from the gang then confirm you’re explaining your answer in short (one line about each is ideal)

- Real – All assets in the company any material or indefinite number as existing records

- Personal – Accounts associated with an individual, entity or any legal body, etc. are called personal accounts

- Nominal – Any records connected with costs & needs or benefits & profits come into this section.

20. Why is Depreciation not Charged on Land?

Oh! This is a classic and one that fascinates the operations manager more than often. There is no scope for leaving this one out of any list of finance and accounting interview questions. The reason why you’ll never see depreciation being charged ashore is that land has an infinite useful life. Without knowing what percentage of years a hard and fast asset will last depreciation can’t be charged.

The formula to calculate straight-line depreciation is (Cost of Fixed Asset – Scrap Value)/Useful life and you don’t have a variety to fill the denominator here.

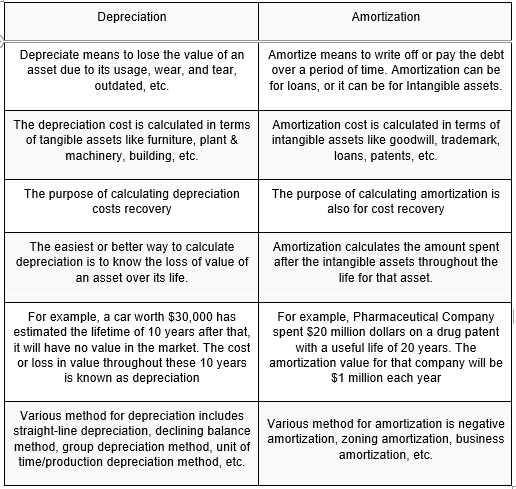

21. What is Amortization?

Amortization is merely finished Intangible assets, unlike depreciation which is for tangible assets. Reduction in value by prorating the value of an intangible over multiple accounting periods is named amortization.

Example – A small-sized technology company Unreal Corp. spends 500,000 on R&D which is expected to sustain for 5 years so it may decide to amortize this & show 1,00,000 each year for 5 years in the financial statements.

If you may wish to deep dive into the topic here is our detailed article on Amortization with an example

22. How is Closing Property not Registered in Trial Balance?

Not all goods purchased in beginning & during the accounting period are sold until the top of that period, this leads to a remainder balance referred to as closing stock.

Closing stock may be a part of purchases & balance already(Trial balance) includes purchases, hence if the closing stock is shown as a separate item it’ll double count and result in an error.

Example: Investing for a while = 60,000, Closing Stock (remainder out of investing) = 10,000, if both of these articles do exist clearly displayed inside balance the result will grow up & claim balance will error out.

The unit too reaches high amongst best investment and accounting interview questions asked in technical rounds by hiring managers.

23. What are the Three Main Financial Statements?

This is another quite common question asked in finance and accounting interviews, especially with entry-level roles. Three main financial statements are earnings report, record, and income Statement.

Again, follow the i.e. to add one brief statement to every one among them, but don’t over-talk it’ll only cause you to susceptible to more questions.

- Income Statement – It presents a summarized view of revenue, income, profit, and loss of a specific accounting period.

- Balance Sheet – B/S would give them as on time assets, accounts & centre area of a company.

- Cash Flow Statement – It shows the movement of money and cash equivalents for a business during an accounting period.

24. What’s Capital, Sort of Account & Where is it Shown Within the Financial Statements?

Also called net worth or owner’s equity, capital is that the money brought in by the owner of the business as an investment to start the operations. Capital may be a Personal Account because it belongs to a private or a firm (owner).

25. What are Fictitious Assets?