Table of Contents

About SAP

SAP is known as System Analysis Program Development. SAP sets the global standard for enterprise resource planning(ERP) software. It is the name of the software as well as the name of the company. SAP software is a European multinational. It was founded in 1972, it has grown from a small five-person venture to a multinational enterprise. The software aims to develop solutions for managing business operations and customer relationships. The company is headquartered in Walldorf, Germany, with over 101,000 employees worldwide. SAP system consists of several fully integrated modules covering virtually every aspect of business management.

SAP FICO Course Training

45-min online masterclass with skill certification on completion

$99 FREE

Access Expires in 24Hrs

Upcoming Batches of SAP FICO Course Training :-

| Batch | Mode | Price | To Enrol |

|---|---|---|---|

| Starts Every Week | Live Virtual Classroom | 34500 | ENROLL NOW |

About SAP FICO

SAP FICO is one of the modules of SAP ERP which is used for financial reporting both externally and internally. The important modules in SAP are SAPFI and SAPCO. Both modules are tightly integrated and help the business organization maintain and generate financial statements for effective decision-making and reporting.

SAP FI deals with external accounting

It records the financial transactions of all movements of goods, services, and all other business transactions between the company and its customers and vendors. SAP Financial Accounting module components enable one to meet all the requirements of the monetary accounting department of an organization. SAP FI generates financial statements for external reporting.

Sub Module of SAP FI

Given below are the Sub-Module of SAP FI:

1. General Ledger Accounting- These are the accounts that will be used for the preparation of financial statements. In SAP a set of all general ledger accounts is called a chart of accounts. Postings that are completed in SAP are recorded through general ledger accounts. These accounts will be used for the preparation of financial statements.

2. Accounts Receivable– It is a submodule that captures all dealings with customers and manages customer accounts. It records all the transactions related to customer accounts.

3. Accounts Payable– It collects and maintains all the transactions related to the vendor account. It is a submodule that captures all transactions with vendors and operates vendor accounts.

4. Bank Accounting– It captures all transactions with the banks. It deals with all the transactions of payments.

5. Asset Accounting– It manages all transactions related to assets for an entity. When transactions are posted in asset accounts, settlement accounts in the general ledger are updated in a period.

SAP CO deals with internal accounting

It provides the operational information to management for a better decision-making process.

Sub Module of SAP CO

Given below are the submodules of SAP CO :

1. Cost Center- It is responsible for recording all the expenses that occur within an organization.

2. Product Costing- This sub-module is used to estimate the cost of producing a product.

3. Profit Center- It records and maintains all the profits of an organization.

4. Profit Analysis- This helps an organization to track and analyze.

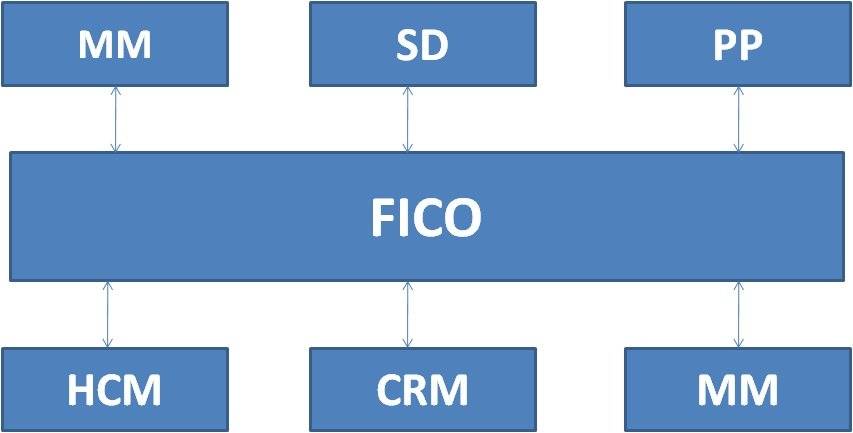

SAP FICO Integration

The combination of SAP FICO with other modules enables automatic updating of transactions to other modules. It can be incorporated with other SAP modules such as Sales& Distribution, Material Management, Human Resource Management, Production Planning, SAP CRM, and so on.

About the SAP FICO course

SAP Financial Accounting and Controlling process and consultant training deliver the understanding and expertise professionals need for better management of financial accounting and reporting in the enterprise. SAP FICO module covers practically all business cycles experienced in different industries.

Benefits of the SAP FICO course

- With the help of the SAP FICO module, you can conduct all the financial transactions, accounting, and reporting activities in a smooth manner within the organization. Whether you are in the manufacturing sector, banking or finance company, healthcare or media service, etc. handling and managing financial accounts is the most of your business. SAP FICO configuration tools, compatibility with other accounting software, and user-friendly features make SAP FICO very popular in the organization. Training in SAP FICO enables you to work efficiently to reach your organization’s goals.

- If you want to work in the field of financial and managerial accounting or want to grow your career in this domain then you should equip yourself with skills in SAP FICO.

- SAP FICO course increases your professional capabilities.

- It gives you a wider picture of business operations and strategic processes.

- SAP FICO course will increase your knowledge of the latest trends in the financial world.

- It will help you in improving the financial processes in the company thereby increasing the value addition.

- The training helps firms and organizations in running their business and grow substantially.

- SAP FICO course will heighten your professional growth and give you better job opportunities.

- After completing the SAP FICO course you will get several excellent job opportunities in reputed companies.

SAP FICO Course Training from Henry Harvin Education

The best institute for pursuing the SAP FICO Course is Henry Harvin Education. The course is recognized by Govt. of India. This SAP FICO course from Henry Harvin Education is well-equipped with highly advanced lab tools and updated course material. The course provides students with specific information on financial accounting and controlling and helps them master the art of using SAP FICO software.

The course is ranked among the top 3 courses in the industry by BestCourseNews.com. Once enrolled in the Finance Academy, you have the facility to attend different batches with different trainers.

The duration of the SAP FICO course is a 44-hour instructor-led training and certification program. You will experience hands-on training with industry projects.

With a membership of SAP Academy, you will get E-learning Access to recorded videos, games, projects, case studies, etc. There are monthly Bootcamp sessions held every month with experts in the field to make you industry-ready. Job opportunities and Internship training are provided with Henry Harvin and partner firms.

Trainers of the institute are industry experts with 10+ years of working experience. Have delivered numerous lectures and are currently working as domain experts with Henry Harvin.

This certified SAP FICO Training course is proof that you have taken a big step ahead in your SAP FICO career in mastering the domain.

Career prospects for SAP FICO- After completing the SAP FICO course candidate can work as an SAP FICO consultant in any IT company. If the person is already working in the Accounting field this will bring several opportunities in the SAP field. As SAP is implemented in 500 top big companies the importance of FICO consultants and career opportunities are very good.

So, Here is the List of Top 35 SAP FICO Interview Questions and Answers in 2021:-

Q1. What is SAP?

Ans. SAP company was founded in 1972. SAP is a German multinational software company. It develops software for the enterprise to manage business operations and customer relations. SAP is the world’s leading producer of software. SAP develops software solutions for managing business operations and customer relationships. In the Enterprise Resource Planning market, SAP is in no.1 position

Q2. What is FICO?

Ans. FICO is a software company that provides products and services to both businesses and consumers. This data analytic company is based in San Jose, California. It focused on credit scoring services. The full form of FICO is the Fair Isaac Corporation. FICO was established by Bill Fair and Earl Issac in the year 1956.

Q3. What is SAP FICO?

Ans. SAP FICO refers to “Financial Accounting” and “Controlling “. SAP FI and SAP CO are the important main modules in SAP that are connected and help businesses and organizations maintain and generate a financial statement for decision-making and reporting. FI and CO are different modules, where the SAP FI deals with external accounting, and SAP CO is connected with internal accounting.

Q4. What are the SAP development modules?

Ans. A few of the SAP development modules are:-

SAP Financial Accounting (FI)

SAP Controlling (CO)

SAP Sales and Distribution (SD)

SAP Production Planning (PP)

SAP Material Management (MM)

SAP Quality Management (QM)

SAP Human Capital Management (HCM)

Q5. What are the reasons for errors in accounting and what effect do they have on the organization?

Ans. An error can occur due to diverse reasons. A single wrong entry of one digit can bring lots of issues in the organization and there can be wrong information about the profit and loss. Errors can also be due to faults in the system, wrongly prepared bills, negligence of users, gross errors, accounting errors, errors due to not updating the sheets, etc.

Q6. Name the organizational element in SAP FI.

Ans. The organizational elements in SAP FI are:

1. Functional Area

2. Company code

3. Business Area

4. Chart of Account

Q7. What is the company code and when it is used?

Ans. For generating financial statements like Profit and Loss Statement, Balance sheets, Profit/Loss statements, etc. It is a code that needs to be entered into the system when it generates the Loss or the profit statements

Q8. How many currencies can be configured for a company code?

Ans. Users can configure up to three currencies one generally remains local and the other can be considered as parallel.

Q9. What are the options in SAP for Fiscal years?

Ans. The fiscal year in SAP is the method of storing financial data in the system. There are 12 periods and four special periods in SAP. These periods are stored in fiscal year variants as:

Calendar Year- From Jan- Dec, April- March

Year dependent fiscal year.

Q10. What is a dependent Fiscal Year in SAP?

Ans. In businesses depending on the type of projects which varies largely, the organizations have to end a month a day earlier or two. For example, the month of July can have 29 days. The same process can be followed with an option in the SAP which is known as Year Dependent Fiscal Year.

Q11. Explain what is posting key is and what is its significance.

Ans. A posting key is a two-digit number that enables users to determine the transaction types. It gives an idea about the type of posting which can either be credit or debit as well as the type of accounts. The status of the transaction can also be recorded through it.

Q12. How many Chart of Accounts does the company code contain?

Ans. There is one Chart of Accounts for one company code that is assigned.

Q13. How many periods are there in the SAP FICO?

Ans. There is a total of 165 periods among which 4 are considered special. They are mostly used when it comes to defining any data that is connected to the fiscal year.

Q14. What is the ‘ year shift ‘ in the SAP calendar?

Ans. The SAP system doesn’t have any provision to access the broken fiscal year. It only understands the calendar year. It is not necessary for all organizations that the calendar year is the financial year. There is usually a need to change months. It can be needed to be added or removed. This process can be done easily in SAP and the same procedure is known as Year Shift.

Q15. What are validations and substitutions in SAP?

Ans. The validation function allows us to analyze values and also analyze the range of values when these are entered into the SAP system. When the values are entered into the SAP system it automatically checks for standard validation rules. The function of substitution is to validate the values entered into the SAP system, as per the prerequisite. Each functional area in SAP Validation or Substitution is defined at the:- Document Level, Line-item Level.

Q16. What is the use of the Financial Statement version in SAP?

Ans. It is a tool that is used for reporting. It can be used to take out final accounts from SAP like Profit and Loss Account etc. When there is a requirement to generate the output of different outside agencies then we can use multiple FSV’s.

Q17. How input and output taxes are taken care of in SAP?

Ans. Tax procedures and tax codes are defined for each country. There is the flexibility to either expense out the Tax amounts or capitalize the same to stocks.

Q18. Validation and Substitutions are used in which application areas?

Ans. These are used in the application areas:

1. Financial Accounting- FI

2. Cost Accounting- CO

3. Asset Accounting- AM

4. Special Purpose Ledger- GL

5. Consolidation- CS

6. Project System- PS

7. Real Estate-RE

8. Profit Center Accounting-PC

Q19. What is a Field status group?

Ans. When the transaction is performed by the user, then field status groups are used to control the fields that are considered. In the Financial General Ledger, the field status group is stored.

Q20. What is the role of Financial General Ledger Accounting?

Ans. For getting an overview of external Accounting and accounts, General Ledger Accounting is used. It is used to record all transactions in business and always gives surety that accounting data is authentic and complete.

Q21. What are the methods through which vendor invoice payments can be made?

Ans. Manual method- When the payment is made without any cheque or draft or DME(Data Medium Exchange) then the process is known as manual.

Automatic method- When the payments are made through DME, wire transfer, draft, or cheque, then it is known as Automatic payments.

Q22. What is the problem area that is encountered when the business area is configured?

Ans. The problem that can occur when a business area is configured is a splitting of the account balance which is highly relevant in the case of tax accounts, then the business can face the problem.

Q23. What is the importance of the Goods Received / Invoice Received clearing account?

Ans. This is an intermediary clearing account. This is used in SAP to record the goods and invoices in transit. It records the goods received but not invoiced. The provision is made in SAP at the receipt of the goods in the legacy system if the goods are received and the invoice is not received.

Q24. What is the meaning of parallel and local currency in SAP?

Ans. Each company code can have two additional currencies, in addition to the company code, the currency is entered into the company code data. When the currency is added to the company code creation is called local currency and the other two additional currencies are called parallel currencies. Two parallel currencies are used in SAP one is a HARD currency and the other is a GROUP currency. When there is the need to do any international transaction then the parallel currency is used.

Q25. How internal orders can be used?

Ans. Internal orders can be used for:

Investment orders: We can monitor internal jobs related to fixed assets.

Accrual orders: The accrued cost is calculated in CO as per offsetting costing.

Overhead orders: We can monitor internal jobs that are related to the cost center.

Orders with Revenue- We only calculate the cost-controlling parts of sales and distribution.

Q26. How to calculate depreciation to the day?

Ans. For that, you have to switch on the indicator Dep. to the day in the depreciation key configuration.

Q27. What are the organizational assignments in Asset Accounting?

Ans. The asset accounting chart of depreciation is rated as the highest node. The depreciation calculations are stored under this chart.

Q28. What asset classes are there? Why is asset class is essential?

Ans. The asset class is defined as the main class to classify assets. For each asset class, only one class is assigned. Examples of asset classes are Furniture & Fixtures, Plant & Machinery, and Computers, etc.

The asset class also contains a G1 account, when any of the assets are procured G1 account is debited. It becomes necessary to mention the asset class for which you are creating the required assets.

Thus, whenever there is any asset transaction that occurs, the G1 account attached to the asset class is automatically picked up and the entry is done. Default values can also be mentioned to calculate depreciation values and master data in every asset class.

Q29. What is APP term in SAP FICO ?

Ans. APP is the abbreviation for ‘ Automatic Payment Program’. This is a tool provided by SAP to companies to pay their vendor and customers. This is a very useful tool to avoid any mistakes that can happen if performed manually.

Q30. What is the meaning of the country chart of account?

Ans. It contains G/L(General Ledger) accounts needed to meet the country‘s legal requirements.

Q31. What is dunning in SAP?

Ans. Dunning is the method by which payment chasing letters are issued to customers. Through the SAP it can determine which customers should receive the letter and also about overdue. Thus different letters can be printed in SAP that depend on the overdue payment date, with a reminder. With the help of the dunning level on the custom master, we can know which letter has been issued to the customer.

Q32. What is the function of “Document type” in SAP?

Ans. Document type is used to define the range of documents. The purpose of “Document type” in SAP is

Types of accounts that can be posted are controlled by it.

The number range for documents is defined by it.

For reversal of entries, it is used.

Q33. What is the meaning of the short-end fiscal year?

Ans. A short-end fiscal year occurs when there is a change from a normal fiscal year to a non-calendar fiscal year. These types of changes happen when a business becomes a part of the new group.

Q34. Customer and Vendor codes are stored at what level in SAP?

Ans. Both the codes are stored at the client level. It signifies that by extending the company code view in SAP it can use the customer and vendor code.

Q35. What is the purpose of the account type field in the General Ledger master record?

Ans. The profit and loss accounts are cleared down to the retained earnings balance sheet account at the end of the year. This field contains an indicator that is linked to specific GL accounts.

Recommended Programs

SAP FICO Course Training

With Certification

SAP FICO Course: Ranked Amongst Top 3 Courses | Recognized by Govt of India | Award Winning Institute | ISO 29990:2010 Certified | Live Online Instructor-led Certified SAP FICO Training & Certification

SAP FICO S/4 HANA Course Training

With Certification

SAP FICO Course: Ranked Amongst Top 3 Courses | Recognized by Govt of India | Award Winning Institute | ISO 29990:2010 Certified | Live Online Instructor-led Certified SAP FICO Training & Certification | Qualify for SAP FICO Certification and Develop a Promising Career in the Field of SAP FICO | 100% Practical Training Method | Training on S/4 HANA Software.

SAP HR ECC Training Course

With Certification

Recognized by Govt. of India | Award Winning Institute | ISO 29990:2010 Certified | One of the most Fundamental Modules of SAP ERP System | Develop a Promising career in the field of SAP HR | SAP HR application module supports the procurement and inventory functions

SAP Security Training Course

With Certification

Leading ERP in the Industry in the most important aspects of current business | Get Introduced to SAP R/3 Architecture, User Administration and SAP Authorization objects | Gain extensive knowledge of SAP Authorization, User Master Records, Profile generation using PFCG

Explore Popular CategoryRecommended videos for you

SAP FICO Course by Henry Harvin®

Ranks Amongst Top #5 Upskilling Courses of all time in 2021 by India Today

View Course

.webp)